China Duty Free Group full-year performance hit by weakness in Chinese economy

China Tourism Group Duty Free Corporation, parent company of China Duty Free Group, today reported a decline in profits in 2024 against the backdrop of soft consumer spending and a slowdown in the Chinese economy.

CHINA. China Tourism Group Duty Free Corporation (CTG), the parent company of the world’s number two travel retailer China Duty Free Group, today reported a decline in profits in 2024 against the backdrop of soft consumer spending and a slowdown in the Chinese economy.

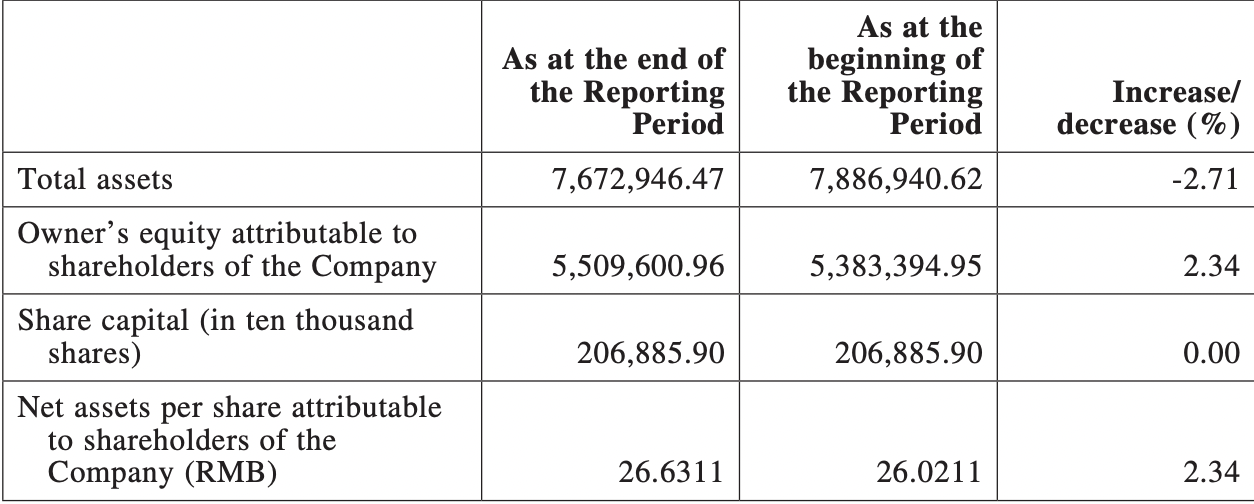

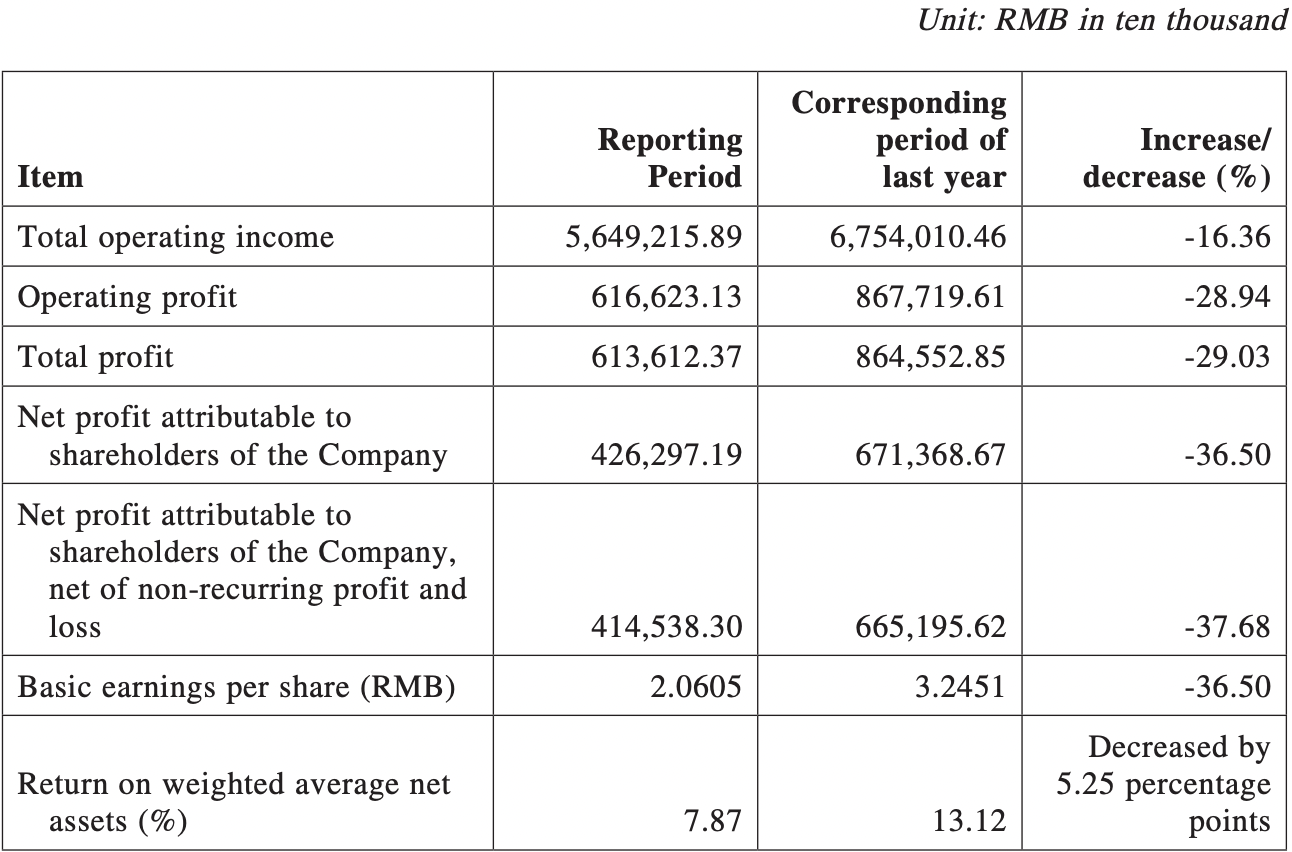

Preliminary results revealed operating income of RMB56.492 billion (US$7.7 billion), representing a year-on-year decrease of -16.36%. Net profit attributable to shareholders of the company reached RMB4.263 billion (US$580 million), representing a year-on-year slide of 36.5%.

The company cited the “market environment and industry cycle” as negative factors, though it cited measures it took to build the business including “deepened reforms and innovations, coordination in market capturing, strengthened management, cost control, quality and efficiency improvement and risk prevention”.

The group said it continued to “move forward under pressure and against the trend” to enhance its business.

Key strategic priorities include expansion in the Hainan offshore duty-free channel.

CTG said: “We introduced the new shopping experience of ‘duty-free+’, created a new paradigm for development that deeply integrates culture, commerce, sports and tourism, resulting in a year-on-year increase of nearly two percentage points in the market share of Hainan’s offshore duty-free industry”.

The airport duty-free business is thriving, CTG noted, with revenue from duty-free shops at Beijing Capital International Airport and Beijing Daxing International Airport increasing by more than +115% year-on-year. Revenue from duty-free shops at Shanghai Pudong International Airport and Shanghai Hongqiao International Airport climbed by nearly +32% year-on-year.

CTG also cited the changing landscape for off-airport stores in China. New rules covering pre-departure downtown duty-free stores represent a key extension to the Chinese travel retail ecosystem announced in August and implemented progressively since 1 October last year.

CTG said: “We have been actively expanding the projects of downtown duty-free shops in new cities, and have successively won bids for projects of four downtown duty-free shops in Shenzhen, Guangzhou, Xi’an and Fuzhou, and the Dalian downtown duty-free shop has reopened.”

CTG highlighted its expansion overseas among the positives in 2024. CDFG opened boutiques at Singapore Changi Airport and Hong Kong International Airport, a duty-free counter for jewellery brands in Tokyo Ginza plus a duty-free shop in The Mall complex in Port City Colombo, Sri Lanka.

CTG also cited its promotion of ‘China chic’ brands through its network as well as enhanced digital engagement with CDFG members, who now number over 38 million.

Concluding, CTG said: “As a next step, the company will actively seize the favourable opportunities presented by vigorous national efforts to boost consumption and expand domestic demand comprehensively.

“We will persist to the principle of seeking progress while maintaining stability, promote stability through progress, remain focused on our main responsibilities and business, capture opportunities for business development and strive to improve the operational quality and efficiency of the company’s operations, driving high-quality development.”

What's Your Reaction?