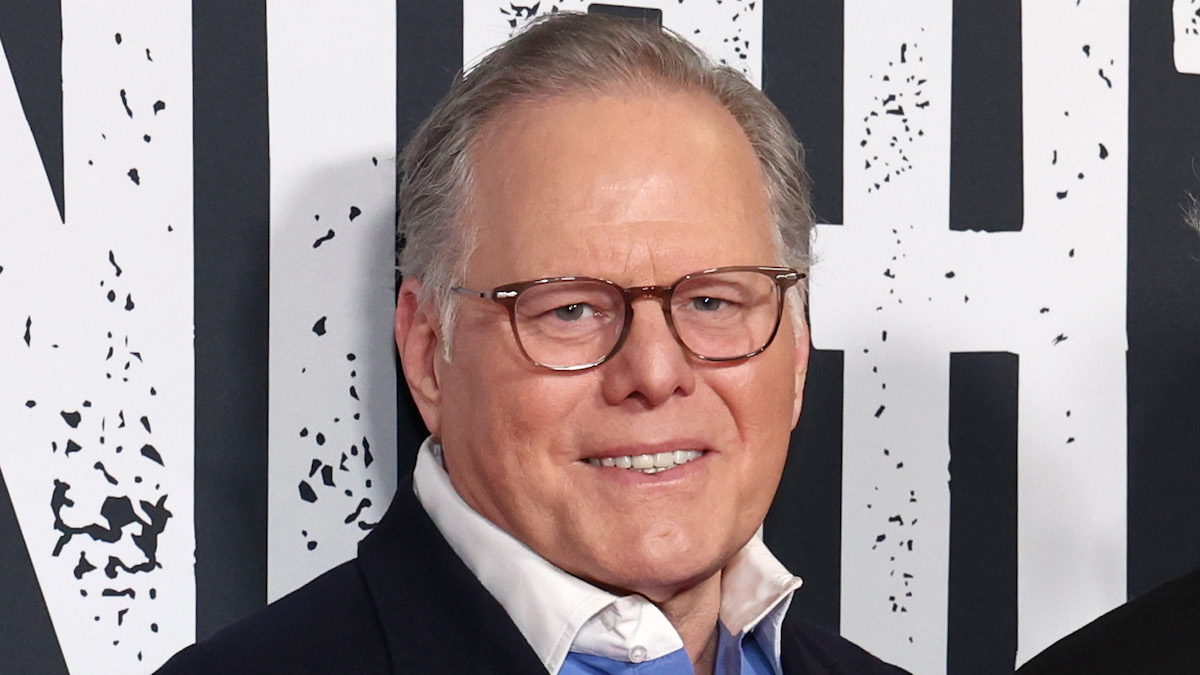

Warner Bros. Discovery to ‘Significantly Reduce’ David Zaslav’s Annual Pay After Split

The move comes after shareholders rejected the chief executive's $51.9 million pay package for 2024 The post Warner Bros. Discovery to ‘Significantly Reduce’ David Zaslav’s Annual Pay After Split appeared first on TheWrap.

After shareholders rejected David Zaslav’s $51.9 million pay package for 2024, Warner Bros. Discovery’s says it will “significantly reduce” CEO David Zaslav’s annual compensation following the split of its global linear network and studios & streaming businesses in mid-2026.

Per a Monday filing with the U.S. Securities and Exchange Commission, WBD will lower Zaslav’s annual cash compensation opportunity and shift the mix in his pay towards long-term incentives. As part of this change, the company will no longer specify performance metric weighting that applies to the annual cash incentive opportunity, annual performance equity awards or performance periods for the annual performance equity awards.

Zaslav will also receive a one-time inducement designed to “incentivize the successful completion of the Separation and stockholder value creation.” Additionally, the compensation committee also adopted a “double-trigger cash severance” provision for Zaslav in the event of a change in control transaction.

“We structured the new compensation packages to address shareholders’ feedback by fostering pay-for-performance alignment, ensuring industry-standard pay structures, and incentivizing contributions to position the two new leading media companies for success and shareholder value creation,” WBD board chairman Samuel A. Di Piazza, Jr. said in a statement.

Upon completion of the separation, Zaslav will become CEO of Streaming & Studios. Under his contract that runs through Dec. 31, 2030, he will receive a $3 million base salary per year and his annual cash bonus opportunity will be reduced to $6 million, with the actual payout based on the achievement of performance goals set by the compensation committee. The annual bonus payout is subject to a cap of 200% of the target amount.

Zaslav will also be eligible for annual equity awards with a target value of $15.5 million in the first year and will be reduced to an annual target value of $7.5 million per year thereafter.

Half of the value of any annual equity grant will be in the form of performance-based restrictive stock units, while the other half will be in the form of time-based restrictive stock units. In the first year of the separation, the annual target bonus will be prorated and Zaslav will only receive one annual equity award for the year.

On June 12, he received a stock option award consisting of 20,898,776 shares in the form of 60% performance-vesting stock options and 40% time-based stock options. The performance based options, which are divided into three tranches of 4,179,755 shares each, will be based on the following targets being reached by June 12, 2030:

- Tranche A: achievement over a period of 30 consecutive days of a volume-weighted average stock price (a “VWAP Price”) equal to or exceeding 120% of the exercise price ($12.19)

- Tranche B: achievement of a VWAP price equal to or exceeding 150% of the exercise price ($15.24)

- Tranche C: achievement of a VWAP price equal to or exceeding 165% of the exercise price ($16.76)

Additionally, he’ll receive an option award for 3,052,734 shares on Jan. 2, 2026, which will be subject to the same split of performance-vesting and time-based vesting conditions, provided that he remains employed on that date. 92% of the stock option grant is subject to forfeiture if a separation or a qualifying transaction does not occur prior to Dec. 31, 2026. If WBD’s stock price exceeds $10.16 per share on Jan. 2, Zaslav will receive additional awards to address lost economic value attributable to the higher exercise price.

Under the new agreement, Zaslav will no longer have a “walk away right,” which allows him to voluntarily terminate his employment between 30 and 60 days following a change in control and receive substantial severance benefits.

Zaslav will continue to be required to hold 1.5 million WBD shares until the separation and an equivalent number of shares of Streaming & Studios following the separation.

Prior to the separation, Zaslav will be eligible for the same employee benefits that he was entitled to under the prior agreement. Those benefits include four weeks of vacation per year, insurance and retirement plans, a car allowance of $1,400 per month and use of a company-provided or other private aircraft for up to 125 hours of personal use per year. If the separation doesn’t occur, those benefits will be available through Dec. 31, 2027.

The post Warner Bros. Discovery to ‘Significantly Reduce’ David Zaslav’s Annual Pay After Split appeared first on TheWrap.

![“[You] Build a Movie Like You Build a Fire”: Lost Highway DP Peter Deming on Restorations, Lighting and Working with David Lynch](https://filmmakermagazine.com/wp-content/uploads/2025/03/1152_image_03-628x348.jpg)

![Red Tape [THE STORY OF QIU JU]](https://jonathanrosenbaum.net/wp-content/uploads/2011/06/thestoryofqiu.jpg)

![‘The Pitt’: Taylor Dearden On The Hit HBO Medical Drama, Psychic Trauma, Neurodivergence, Season 2 & More [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/06/13131253/THE-PITT-TAYLOR-DEARDEN.jpg)

![Idiot Tourist Destroys Swarovski-Covered ‘Van Gogh’ Chair At Italian Museum After Mistaking It For A Seat [Roundup]](https://boardingarea.com/wp-content/uploads/2025/06/e10807c829f9d13fb399acc7b815297c.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)