What You Should Know About Transferring American Express Membership Rewards to Hilton Hotels

All information about American Express Green Card, Amex EveryDay® Preferred Credit Card, Hilton Honors American Express Aspire Card, The Amex EveryDay® Card and Business Green Rewards Card has been collected independently by MileValue.com American Express Membership Rewards is one of the major flexible rewards programs. The post What You Should Know About Transferring American Express Membership Rewards to Hilton Hotels appeared first on MileValue.

All information about American Express Green Card, Amex EveryDay® Preferred Credit Card, Hilton Honors American Express Aspire Card, The Amex EveryDay® Card and Business Green Rewards Card has been collected independently by MileValue.com

American Express Membership Rewards is one of the major flexible rewards programs. Points earned with American Express cards and special offers can be used in different ways, including booking travel directly through Amex Travel and transferring points to specific airline and hotel loyalty programs, including Hilton Honors.

Hilton Honors is the loyalty program for Hilton, which is one of the leading worldwide hotel chains, with properties in many locations and diverse brands and accommodation styles that fit most travelers’ needs.

If you’re considering a Hilton property for an upcoming trip and are interested in using points instead of cash to pay for the stay, you may be thinking about transferring Membership Rewards points to Hilton and wondering if this is a good idea. As with many things in the points and miles world, the answer depends on the particular situation.

Earning and Redeeming Membership Rewards Points

The easiest way to obtain American Express Membership Rewards points is through welcome bonuses, spending and other offers on multiple American Express cards:

The following consumer cards earn Membership Rewards points:

- American Express® Gold Card (see rates and fees)

- American Express® Green Card

- Amex EveryDay® Preferred Credit Card (not available to new applicants)

- The Amex EveryDay® Card (not available to new applicants)

- The Platinum Card® from American Express (see rates and fees)

American Express® Gold Card

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

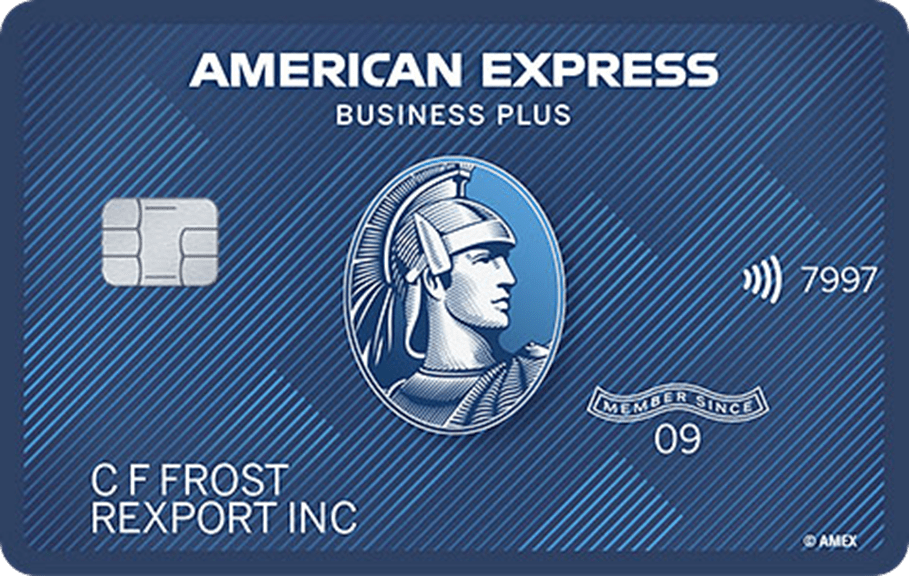

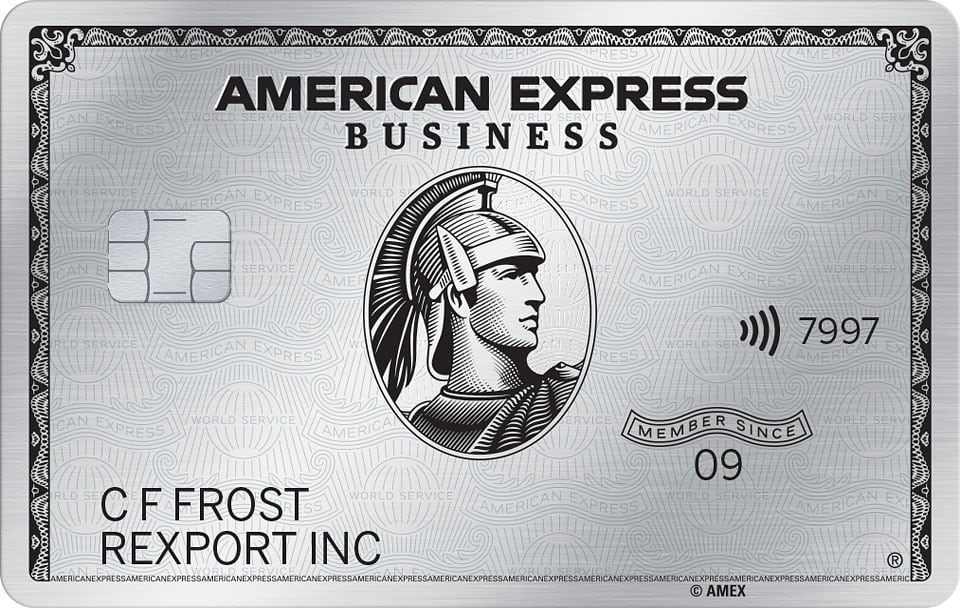

The following business cards earn Membership Rewards points:

- American Express® Business Gold Card (see rates and fees)

- Business Green Rewards Card

- The Blue Business® Plus Credit Card from American Express (see rates and fees)

- The Business Platinum Card® from American Express (see rates and fees)

Earn 100,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.

The Blue Business® Plus Credit Card from American Express

Earn 15,000 Membership Rewards® points after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership.

The Business Platinum Card® from American Express

Limited Time Travel Offer: Earn 150,000 Membership Rewards® points after you spend $20,000 on eligible purchases on your Business Platinum Card® within the first 3 months of Card Membership. Plus, earn a $500 statement credit after you spend $2,500 on qualifying flights booked directly with airlines or through American Express Travel® with your Business Platinum Card® within the first 3 months of Card Membership. You can earn one or both of these offers. Offer ends 6/30/25.

Membership Rewards points can be redeemed directly for travel purchases through Amex Travel and can be transferred to partners, including Hilton. When transferring Amex points to Hilton, the usual ratio is 1:2, so 1,000 Membership Rewards points become 2,000 Hilton points.

Transfer bonuses occur periodically and improve the standard transfer ratio. The most recent transfer bonuses have been 25% or 30%, which means that 1,000 Membership Rewards points yield:

- 2,500 Hilton points with a 25% bonus

- 2,600 Hilton points with a 30% bonus

Earning and Redeeming Hilton Honors Points

Before discussing whether it makes sense to transfer Membership Rewards to Hilton, let’s look at some details about earning and redeeming Hilton Honors points.

Obtaining Hilton Honors Points

American Express and Hilton have several co-branded credit cards that earn Hilton points for welcome bonuses, spending and special offers:

- Hilton Honors American Express Aspire Card

- Hilton Honors American Express Surpass® Card

- Hilton Honors American Express Card

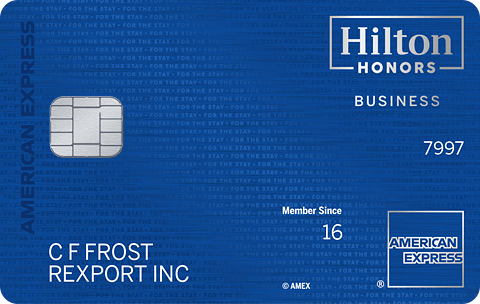

- The Hilton Honors American Express Business Card

Hilton Honors American Express Surpass® Card

Earn 130,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership.

The Hilton Honors American Express Business Card

Welcome Offer: Earn 130,000 Hilton Honors Bonus Points after you spend $6,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership.

Other ways to increase your supply of Hilton points is by earning points on hotel stays and through select partners, buying points from Hilton or transferring Membership Rewards or other types of points to Hilton.

The regular rate at which Hilton sells points is 1 cent each, but there are frequent promotions during which Hilton sells points with up to a 100% bonus. With a 100% bonus, you get double the number of points for the same cash outlay, and the net cost of buying points is 0.5 cent apiece. For example, spending $200 to purchase points yields 20,000 points without a bonus or 40,000 points with a 100% bonus.

Redeeming Hilton Honors Points

It’s important to have an idea of how much each Hilton point is worth to you. This influences decisions about when it makes sense to obtain or redeem points. There are two perspectives to consider:

- Acquisition cost: As discussed above, Hilton frequently offers bonuses that allow members to buy points for 0.5 cent each. Other ways of obtaining Hilton points may have lower acquisition costs. One example is business travel paid for by an employer. If you have a choice of hotel chains for business travel, there are some opportunity costs for choosing Hilton over another hotel chain. Using Hilton credit cards also has opportunity costs related to sacrificing points or cash back earned if using alternative cards.

- Average or floor value for redeeming points: When looking at hotel rates on Hilton’s website or app, it’s easy to do a rough estimate of the redemption value for a possible stay. Once you’ve selected the hotel, stay dates, room type and checked the special rates option “use points,” you’ll see a pre-tax cash rate and a points rate. By dividing the room rate by the number of points, the result will be a rough estimate of the value obtained if redeeming points. For example, if the initial cash rate is $200 and the points rate is 50,000 points, the redemption value is $0.004 or 0.4 cent per point. This estimate can be refined by using cash rates with taxes and incorporating points earned. Analysis conducted for different properties and dates often show redemption values between 0.4 and 0.6 cent per point.

Using acquisition cost, minimum / target redemption value or a combination of the two perspectives is another choice to make. The biggest rule is that you shouldn’t redeem points for lower value than your acquisition cost.

Dynamic Award Rates

Hilton Honors eliminated award categories and award charts several years ago, and award rates are dynamic. Pricing for premium rooms is highly variable, but in recent years, there have been significant increases in the standard room award rates—which typically are used for base rooms and are capacity constrained—at many properties, as summarized on Upgraded Points.

- In 2022, most of the top Hilton properties award rates for standard rooms were 95,000 points per night or fewer, with only a handful of properties above this threshold.

- During 2022 to 2023, many of the properties that previously had standard room awards for 95,000 points per night increased the award rates to 110,000 points or higher.

- Following the launch of Hilton’s partnership with Small Luxury Hotels (SLH) in late 2024, another increase in standard room award rates at some high-end properties was observed, and many SLH properties and other high-end hotels now have standard room award rates of 100,000 to 150,000 points per night.

- In May 2025, the observed maximum standard room award rates at some hotels increased again, up to 200,000 points per night.

Although award rate devaluations at higher-priced Hilton properties received more attention, award rates for booking Hilton properties generally have increased for lower (up to 30,000 points per night) and middle-range (between 30,000 and 65,000 points per night) redemptions. With some exceptions, it’s difficult to find awards for mid-range properties that yield at least 0.5 cent per point. Some good deals remain using points at the lower end of the points scale, but they don’t seem as common as in the past.

Lower-Tier Good-Value Redemption Example

It’s possible to get decent value using Hilton points at more moderately priced properties. The following example is for the SLH property The Edison George Town in Penang, Malaysia.

- Award rates under Hyatt: This property was a Category 3 Hyatt property under the previous partnership between Hyatt and SLH that ended in early 2024. Standard date award rates were 12,000 Hyatt points per night, with peak and off-peak rates of 15,000 points and 9,000 points respectively. Standard rates seemed to apply to most dates at this hotel.

- Initial award rates under Hilton: When Hilton assumed the SLH partnership and made The Edison available for booking with points, standard room award availability (as of December 2024) was 25,000 Hilton points per night for every day in March 2025.

- Updated award rates under Hilton: When checking again in mid-March 2025, standard award rates had increased to 30,000 Hilton points per night for remaining dates in March and future months.

With cash rates including taxes for the same room type slightly above $200 for dates checked in March 2025, using Hilton points provides a redemption value of almost 0.7 cent per point. This is above the threshold of 0.5 cent per point many travelers use for deciding whether to redeem Hilton points or pay cash.

Fifth Night Free on Award Stays

Additionally, if you have Hilton Honors Silver, Gold or Diamond status and are booking a Hilton award stay of at least five nights, every fifth night is free when booking standard room awards. For example, booking a 10-night stay with an average award rate of 50,000 points per night requires 400,000 Hilton points instead of 500,000 points.

Payment Options for Hilton Stays

There are three major ways—with some overlap and variations—to pay for Hilton stays.

- Pay cash: You can book cash rates directly through Hilton or through third-party booking channels. The latter includes online travel agencies (OTAs) such as Expedia, credit card travel portals and brick-and-mortar travel agencies. Unless you’re getting other benefits or a better rate with a third-party booking, it’s usually better to book cash stays directly with Hilton. Stays booked through third parties typically don’t earn Hilton points, and guests with elite status don’t receive Hilton Honors benefits.

- Redeem Hilton Honors points or use free night certificates: To simplify, this includes stays paid for entirely with Hilton points, a combination of cash and Hilton points, and Hilton free night certificates. The certificates are most valuable when used to book expensive properties because they’re valid at the vast majority of Hilton properties. If you transfer Membership Rewards points to Hilton, when you book a hotel, the booking is a full points (or points and money) stay.

- Use flexible rewards points through travel portals: In addition to paying cash to book hotels through bank travel portals, Amex Travel and other bank travel sites allow you to use points to pay for hotel stays. When using Membership Rewards points to book hotels through Amex Travel, the redemption rate is between 0.7 and 1 cent per point and typically doesn’t provide strong value.

Which option works best depends on many factors including:

- Cash rate for the desired room: It’s important to look at pre-tax as well as the total cost of the room. Most taxes and fees don’t apply to award stays, so many points and miles experts use the total cash rate to calculate redemption value. The impact of using pre-tax or total cost is more significant when taxes and fees are higher. Total taxes and fees range from less than 10% to over 25%.

- Points rate for the desired room: One thing to note is that there often is huge variation in Hilton awards rates for standard rooms and premium rooms. Standard rooms often are the base rooms that the property makes available for award stays. To secure reasonable award rates, leverage the fifth-night-free benefit or use Hilton free night certificates, the hotel must have standard rooms available.

- Points earned for the stay: Quantifying this is complex because an individual’s Hilton status and credit cards used for cash stays impact the number and type of points earned. Hilton sometimes has bonuses that apply to cash stays (for example, double base points), but other bonuses apply to cash or award stays.

- Points available (Hilton Honors, Membership Rewards, others), preferences for using cash or points and personal valuation of points: Points and miles experts agree that all points aren’t equal. Specifically considering Hilton points and Membership Rewards points, common valuations are 1 Hilton point = 0.5 cent and 1 Membership Rewards point = 1 to 2 cents. In other words, 1 Membership Rewards point has the same value as 2 to 4 Hilton points. Another consideration is which type of points an individual may want to use, given preferences for collecting a specific type of points and potential alternative uses.

Let’s look at this from a mathematical perspective. In this hypothetical example, a traveler wants to book a one-night Hilton stay, and the following parameters apply:

- Cash rate: $400 pre-tax and $480 with 20% taxes and fees that apply to cash rates but not points rates

- Points rate: 80,000 points

- Points earned: As a Hilton Honors Silver member—the status level automatically provided with the $0 annual fee Hilton Honors American Express Card (see rates and fees)—the traveler earns 12X points per dollar on the pre-tax room rate (10X base points with a 20% Silver elite bonus). Assuming the room is paid for with the same credit card, 7X points per dollar are earned on the total room rate. Points earned in this example are 12 x 400 + 7 x 480 = 8,160. We won’t consider any other bonuses.

- Points balances, preferences for using cash or points, and points valuation: This individual has 200,000 Amex points (valued at 1.5 cents each) and 250,000 Hilton points (valued at 0.5 cent each) and doesn’t have strong preferences about using cash or points. Instead, the objective is to maximize value.

Given these details, redeeming Hilton points provides a return of about 0.54 cent each, calculated as: $480 / 88,160 x 100. The numerator is the total cash rate, and the denominator is the sum of 80,000 points redeemed and 8,160 points, which is the opportunity cost of forsaking points earned on a cash stay.

Since the redemption value exceeds 0.5 cent per point, the individual likely would use Hilton points. Given that 0.54 barely exceeds 0.5, there could be other factors that would result in paying cash instead of using points. Perhaps this individual is trying to accumulate more Hilton points to use for a future stay with an expected higher redemption value. Another reason is if the stay coincided with a Hilton bonus on cash rates.

Given that the standard transfer ratio from American Express to Hilton is 1:2, and the individual values Membership Rewards points at 1.5 cents each, transferring Membership Rewards points to Hilton is equivalent to buying Hilton points at 0.75 cent each, which doesn’t make sense for this redemption opportunity.

Situations to Consider Transferring Membership Rewards Points to Hilton

Individual and redemption-specific circumstances play a significant role in determining if transferring Membership Rewards points to Hilton Honors makes sense. Let’s discuss a few scenarios where it could be beneficial to transfer Membership Rewards points to Hilton to redeem for a hotel stay. The decision could be based on one factor or a combination of these factors.

Limited Hilton Points and Many Membership Rewards Points

Many points and miles enthusiasts focus their efforts on collecting flexible rewards that can be transferred to multiple partner programs, rather than earning points in specific airline and hotel loyalty programs.

Individuals following this approach might not have enough Hilton points for a redemption, but they may have a large balance of Membership Rewards points and be comfortable transferring some of these points to Hilton. Having a large Membership Rewards points balance also makes it possible to use points for both flights and hotels, rather than having to choose one or the other.

While not exactly the same as having a large balance of Membership Rewards points, the ability to obtain more Membership Rewards points easily at a low acquisition cost is another factor that makes some individuals more willing to transfer Amex points to Hilton.

Alternative Uses of Membership Rewards Points

A portion of the points and miles community believes that the best use of flexible currency is to transfer points to airlines to use for high-value redemptions, such as long-haul international business- or first-class flight awards. One size doesn’t fit all, so if you aren’t likely to need Membership Rewards points to book expensive flights, using Amex points to book Hilton hotels might be a good option.

Preference for Using Points Instead of Cash

Many of us collect points and miles so we can meet our travel objectives while spending less cash. The desire to save cash for other uses may mean that some individuals use points for a hotel stay that provides a lower redemption value. Also, some points and miles enthusiasts are more likely to indulge in an expensive hotel (or flight) if they can use points rather than spending cash.

Membership Rewards Transfer Bonuses to Hilton

As discussed above, periodic transfer bonuses to Hilton make the transfer ratio more favorable, and a transfer bonus may tip the scales for individuals on the fence about paying a cash rate, buying Hilton points or transferring Membership Rewards to Hilton.

The decision process is complicated because it’s dependent on personal valuations of Hilton points and Membership Rewards points, bonus opportunities for buying Hilton points and willingness to spend cash to buy points vs. transferring existing points.

- In the previous example, we discussed that an individual who values Hilton points at 0.5 cent each and Membership Rewards points at 1.5 cents each wouldn’t transfer Membership Rewards points to Hilton at the standard 1:2 transfer ratio.

- With a 30% transfer bonus from Amex to Hilton, the decision might be different, since the transfer bonus reduces the effective cost of transferring Amex points from 0.75 cent each to a value closer to the cost of buying Hilton points for 0.5 cent each.

One caution is to be careful about transferring Membership Rewards points to Hlton—even with a 25% or 30% transfer bonus—if you don’t have plans to use the points soon to book a stay with a high enough redemption value.

High-Value Redemption Opportunity

If a traveler is planning to stay at a property with cash rates that are high enough that using points provides a redemption value above 0.75 cent each, it may be worthwhile to transfer Membership Rewards to Hilton.

For example, a $1,000 cash rate (including taxes) vs. an award cost of 110,000 points is a redemption value of about 0.9 cent per point without factoring in points earned. For someone who values Membership Rewards points at 1.5 cents each, transferring Membership Rewards points would be worthwhile at the standard 1:2 transfer ratio.

Fifth Night Free with Points

Another scenario that increases the redemption value is leveraging a benefit—available to Hilton Honors Silver, Gold and Diamond elite members—to get the fifth night free when booking a standard room award for a stay of at least five nights.

This benefit provides the greatest value for stays in increments of exactly five nights. For example, at a property with an average nightly rate of 50,000 points, a five-night stay requires a total of 200,000 points. This is the same number of points as required for a four-night stay and represents a 20% discount on an award stay.

General Use of Flexible Rewards for Booking Hotels

If you’re open to hotels outside the Hilton chain and/or using other flexible rewards points, it’s possible to book other chain and independent hotels. Some considerations are:

- Bilt Rewards and Membership Rewards are direct transfer partners with Hilton Honors, but unless Bilt has a transfer bonus to Hilton, the usual transfer ratio is poor at 1:1.

- Other flexible rewards programs partner with different hotel loyalty programs, as detailed below.

- Flexible rewards programs also support booking hotels with points directly through their travel booking sites.

Similar to using Membership Rewards points to book Hilton properties, it’s important to consider the transfer ratio to hotel programs, your valuation of points, alternative uses of flexible rewards and redemption rates through travel portals.

Booking via Travel Portals

When using flexible rewards program points to book hotels through travel portals, key considerations are availability of the desired hotel and room type, room rates and the portal’s redemption rate for booking with points. Some additional details follow.

- The best redemption rates for hotel bookings generally are possible with Chase Ultimate Rewards or Bilt Rewards, with other programs having redemption rates of 1 cent per point (cpp).

- Redemption rates through Chase Travel℠ vary depending on which credit cards an individual holds, with the Chase Sapphire Reserve® providing a redemption rate of 1.5 cents per point and the Chase Sapphire Preferred® Card and the Chase Ink Business Preferred® Credit Card providing a redemption value of 1.25 cents per point.

- Redemption rates through the Bilt Rewards portal are 1.25 cpp.

- Booking a hotel with a cash rate of $250 requires 25,000 points at 1 cpp, 20,000 points at 1.25 cpp or 16,667 points at 1.25 cpp.

Transferring to Hotel Partners

The table below shows hotel loyalty programs in the left column and transfer ratios for transfers from several flexible rewards programs—American Express Membership Rewards, Bilt Rewards, Capital One Rewards, Chase Ultimate Rewards and Citi ThankYou® Rewards—in the following columns. The last column shows an estimated value for each type of hotel point.

Hotel programs Flexible rewards transfer ratios Estimated hotel point value (cents) Amex Bilt Capital One Chase Citi Accor Live Limitless (ALL) 3:2* 2:1 2:1 ~1.10** Choice Privileges 1:1 1:1 1:2* 0.6 – 0.8 Hilton Honors 1:2* 1:1 ~0.5 IHG One Rewards 1:1 1:1 ~0.5 Leading Hotels of the World Leaders Club 5:1 ~8 Marriott Bonvoy 1:1 1:1 1:1 ~0.75 Preferred Hotels & Resorts I Prefer℠ Hotel Rewards 1:4 ~0.5 World of Hyatt 1:1 1:1 1.5 – 2 Wyndham Rewards 1:1 1:1 0.8 – 1.1

Notes:

* This is the best transfer ratio to the hotel loyalty program for situations where transfer ratios aren’t the same for all flexible rewards programs.

** Point value in cents depends on the exchange rate between U.S. dollars and euros. ALL points are worth a fixed rate of 1 euro cent per point towards cash rates at Accor properties.

With many points and miles experts valuing flexible rewards at 1.5 cents each or higher, it’s usually considered a poor use of flexible rewards to transfer points at a 1:1 ratio to hotel loyalty programs where the typical value of each point is under 1 cent each. This isn’t absolute, so a transfer bonus, a high-value redemption opportunity and your personal valuation of points might change the math.

Let’s look at an example for a one-night stay on Nov. 6, 2025, near Los Angeles International Airport (LAX), a common layover for international travelers. We’ll compare mid-range full-service airport hotels with shuttle bus service to LAX across major chains, using one hotel per chain if there are multiple options.

To limit complexity, we’re ignoring points earned and calculating each hotel’s redemption value using the lowest refundable (with a cancellation policy similar to the points rate) cash rate with all taxes and fees. Hotel and rewards currency values are expressed in cents per point. The rewards currency value adjusts for the different transfer ratios and should be compared to your valuation of the relevant flexible currency.

Hotel name Cash cost Points cost Transfer details Base rate Total rate Points rate Hotel points cpp From # of points Flexible points cpp Hilton Los Angeles Airport $156 $184 55,000 0.33 Amex 27,500* 0.67 Holiday Inn: Los Angeles – LAX Airport $151 $176 24,000 0.73 Bilt, Chase 24,000 0.73 Hyatt Regency Los Angeles International Airport $188 $ 218 12,000 1.82 Bilt, Chase 12,000 1.82 Sheraton Gateway Los Angeles Hotel $185 $214 41,000 0.52 Bilt, Chase 41,000 0.52

Notes:

* Transfers are in increments of 1,000 points. Assuming a beginning balance of 0 Hilton points, 28,000 points would be transferred and result in a balance of 1,000 Hilton points after booking.

Some thoughts about these results are:

- The Holiday Inn provides good redemption value if you already have IHG points or purchase points when IHG is selling them for 0.5 cent each during a 100% bonus promotion, but a poor value if transferring Bilt or Chase points.

- The Hyatt Regency provides fair to good redemption value, whether using Hyatt points you already have or transferring Bilt or Chase points to Hyatt.

- The Hilton and Sheraton options provide poor redemption values using existing hotel program points and worse value if transferring flexible rewards 1:1 from the relevant programs.

Final Thoughts

Deciding whether or not to transfer flexible rewards to hotel programs requires detailed analysis that starts with understanding how much the hotel program and flexible currency points are worth to you. Once you have done this and assessed redemption specific factors—including cash rates, points rates and personal preferences, you can make an informed decision about how to pay for a specific hotel stay.

Factors that make transferring Membership Rewards points to Hilton more attractive include:

- Having a large balance of Membership Rewards points or being able to amass them easily at low cost, while not having many Hilton points or being able to accumulate them at an acceptable cost.

- Being in a situation where you don’t plan to use Membership Rewards points to book airline tickets.

- Preferring to book hotels using points rather than spending cash to book direct or buy Hilton points.

- Transferring Membership Rewards points during a transfer bonus that yields more Hilton points than usual.

- Booking a Hilton property that provides a high redemption value when using points compared to paying cash.

- Booking a stay of at least five consecutive nights to get the fifth night free with standard room awards.

The post What You Should Know About Transferring American Express Membership Rewards to Hilton Hotels appeared first on MileValue.

![‘Teacher’s Pet’ – Barbara Crampton & Luke Barnett Star in High School Thriller [Images]](https://bloody-disgusting.com/wp-content/uploads/2025/06/TP_STILLS_3-1024x436.jpg)

![Konami Reveals ‘Silent Hill’ Remake Currently in Development From Bloober Team! [Watch]](https://bloody-disgusting.com/wp-content/uploads/2025/06/silenthill.jpg)

![Where the Boys Are [BULL DURHAM]](https://jonathanrosenbaum.net/wp-content/uploads/2010/08/bull-durham.jpg)

-0-6-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg)