FTC Rejects Korean Air–Asiana Mileage Integration Plan

South Korea’s Fair Trade Commission (FTC) has rejected Korean Air’s proposed plan to integrate mileage programs with Asiana Airlines, dealing a setback to the carriers’ long-delayed merger process. The FTC announced on Thursday that the submitted proposal was insufficient for a full review, citing a […]

South Korea’s Fair Trade Commission (FTC) has rejected Korean Air’s proposed plan to integrate mileage programs with Asiana Airlines, dealing a setback to the carriers’ long-delayed merger process.

The FTC announced on Thursday that the submitted proposal was insufficient for a full review, citing a lack of transparency around the mileage integration ratio and inadequate consumer protections.

Reports suggest that the proposed conversion ratio would have significantly devalued Asiana miles, with a conversion value of 1 Korean mile equal to 0.7 Asiana miles, representing a 30% devaluation.

You would have thought that these miles would have been converted at a 1:1 ratio, as with most airlines I remember being part of that have been acquired. Offering anything else would have been insufficient.

Consumer Protection

The FTC emphasized that any integration must not disadvantage Asiana customers compared to the airline’s 2019 program terms. This condition dates back to a 2022 ruling when the FTC approved Korean Air’s acquisition of a controlling stake in Asiana, stipulating that key customer benefits must be preserved.

Combined Mileage Pool of ₩3.7 Trillion at Stake

Combined, the two airlines hold an estimated ₩3.7 trillion (US$2.7 billion) in outstanding mileage liabilities. With Korean Air having officially absorbed Asiana as a subsidiary in December 2024, the mileage integration was seen as a critical final hurdle before the complete operational merger, scheduled for no earlier than October 2026.

Korean Air & Asiana Merger Developments

Korean Air Acquires 64% Stake in Asiana

Update: Asiana – Korean Air Merger Nearing Final Phase With U.S. Antitrust Approval Expected Soon

Korean Air’s Takeover Of Asiana Inches Closer

Korean Air’s Asiana Acquisition About To Collapse

Conclusion

Korea Air is doing itself a disservice by not offering to merge at the only right value for all parties, which is 1:1.

Both Asiana and Korean Air are full-service airlines with highly similar mileage-earning schemes.

There is no excuse for Korean Air to attempt to gain financially by devaluing the value of Asiana miles when they are being merged into Korean.

A new timeline indicates that this carrier merger is likely to occur no earlier than October 2026.

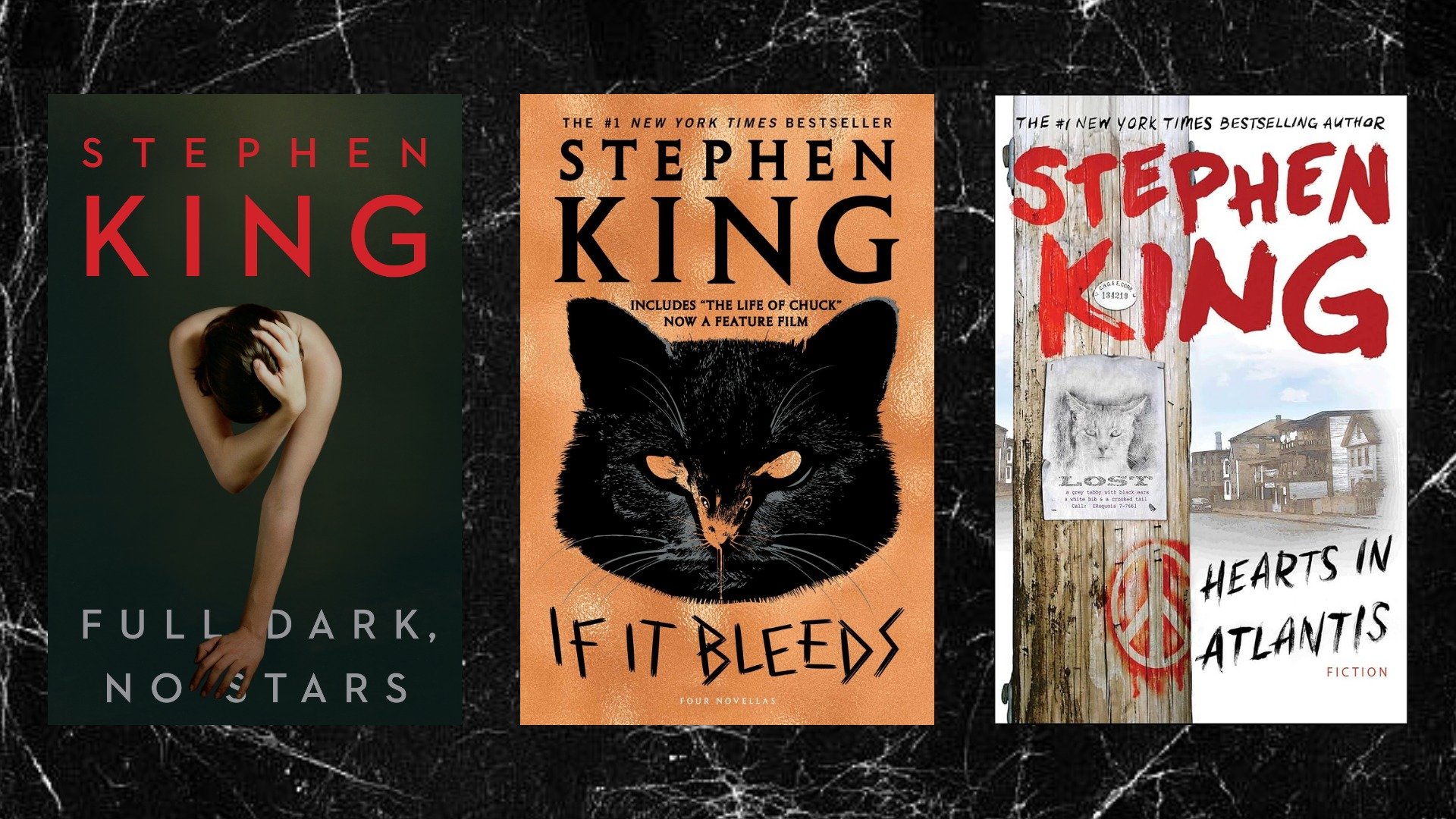

![‘The Life of Chuck’ – Mike Flanagan & Kate Siegel Spotlight the Horror Stars in Stephen King Movie [Video]](https://bloody-disgusting.com/wp-content/uploads/2025/06/Screenshot-2025-06-12-134913.png)

![‘Yellowjackets’: Christina Ricci Talks Misty Quigley’s Evolution, That Leather Jacket, Her Complicated Walter Bond & The Show’s Shifting Arc [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/06/12125824/Christina-Ricci-Yellowjackets.jpg)

![‘Dying For Sex’: Creators Liz Meriwether & Kim Rosenstock Talk Michelle Williams & Jenny Slate Fearlessness, Sexual Awakenings & The Intimacy Of Showing Up For Friends [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/04/04151935/FXs-Dying-for-Sex-Media-Guide-3.jpg)

-35-45-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-30-7-screenshot_0FxoE4J.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)