Bluebell Group research reveals evolving luxury priorities among Asian consumers

The findings are based on Bluebell Group’s fifth annual Asia Lifestyle Consumer Profile, drawn from a March 2025 survey of 1,500 luxury consumers across Mainland China, Hong Kong SAR, South Korea, Japan and Southeast Asia.

ASIA PACIFIC. Leading Asian brand distributor and operator Bluebell Group has highlighted a shift in consumer sentiment, marked by declining confidence and changing perceptions of luxury across Asia, most notably in China.

The findings are drawn from Bluebell Group’s fifth annual Asia Lifestyle Consumer Profile, released recently and based on an Asia-wide survey conducted in March of this year. The survey covered 1,500 luxury consumers across Mainland China, Hong Kong SAR, South Korea, Japan and Southeast Asia, all of whom had spent a minimum of US$1,200 on lifestyle products in the past six months.

The study reveals a declining optimism for the future in China (94%, -3pts), Southeast Asia (90%, -3pts) and Japan (74%, -4pts), with Chinese consumers also reporting a steep drop in travel intent.

Alongside a conflicting increase in spending intent, the survey outcomes suggest a market in transition – “hopeful but volatile” – urging brands to adapt to changing trends rather than depend on past momentum.

Bluebell Group President & CEO Ashley Micklewright said, “This year’s findings reflect a more discerning, digitally connected and value-driven luxury consumer across Asia.

“Brands can no longer rely on heritage or aspiration alone – they must prove their worth across every touchpoint. Whether it’s through quality, relevance, innovation or service, the new luxury equation is about earning trust and loyalty in distinct markets that are both fast-evolving and fundamentally recalibrating.”

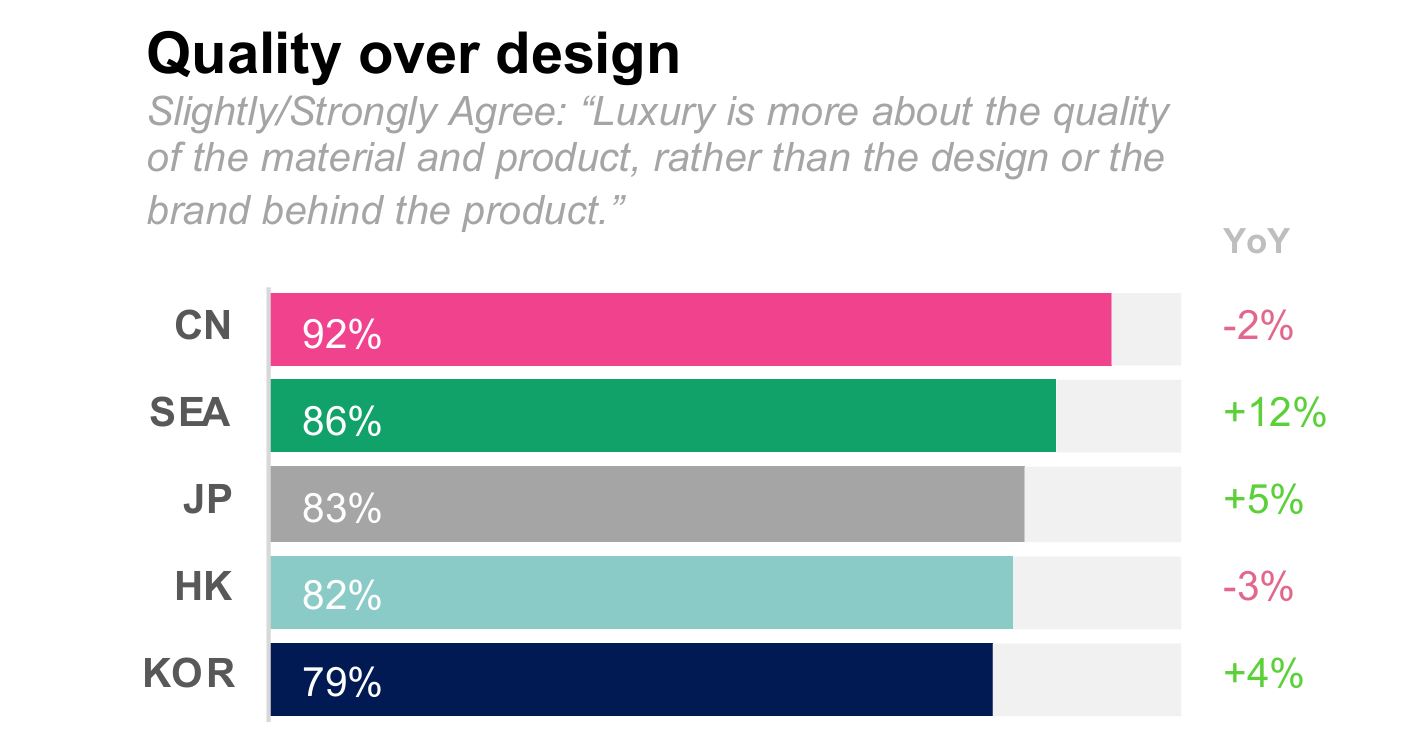

Substance over form

Key highlights of the study reveal that as luxury becomes more accessible and prices continue to rise, Asian consumers are becoming more discerning – expecting brands to justify their pricing through product quality, performance, investment value and resale potential.

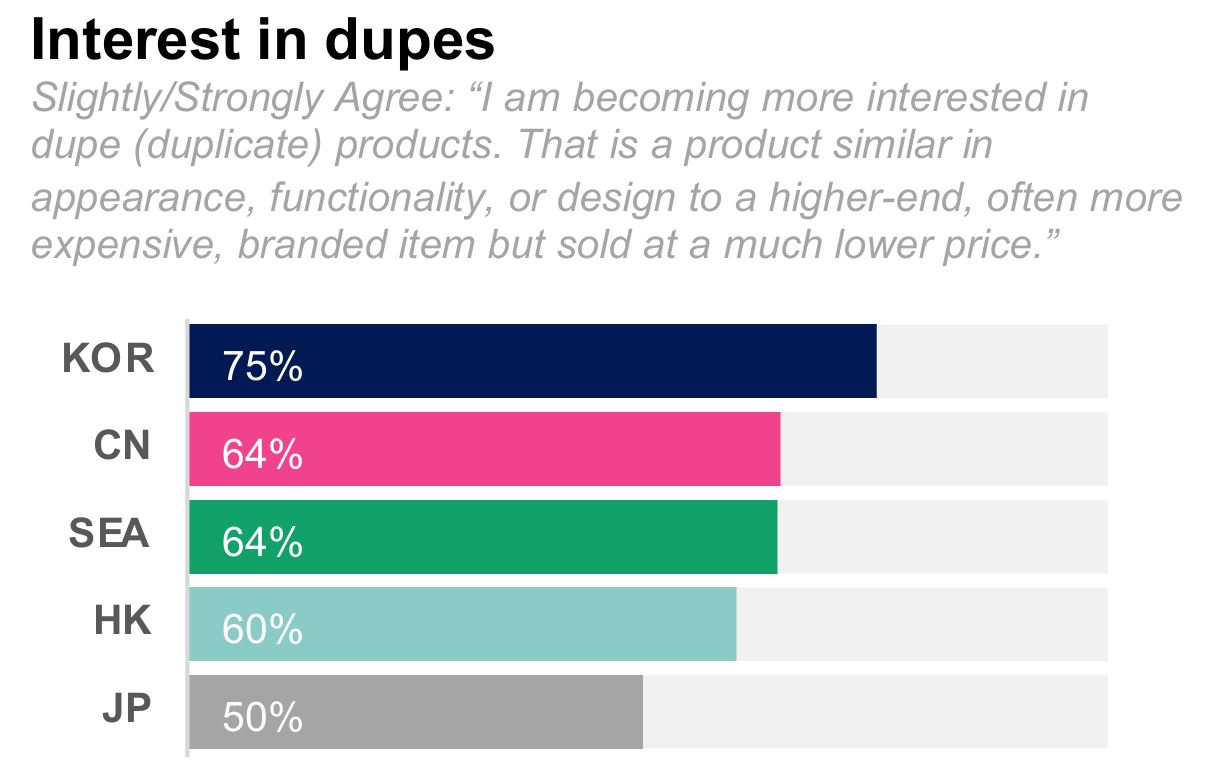

The research also suggests that as Asian consumers prioritise value, demand for dupes is also rising, with 75% of Koreans and 64% of Chinese and Southeast Asians open to more affordable imitations.

The findings collectively reflect consumers’ growing emphasis on value, urging brands to validate their pricing through proven quality and long-term value.

The rise of local and niche brands

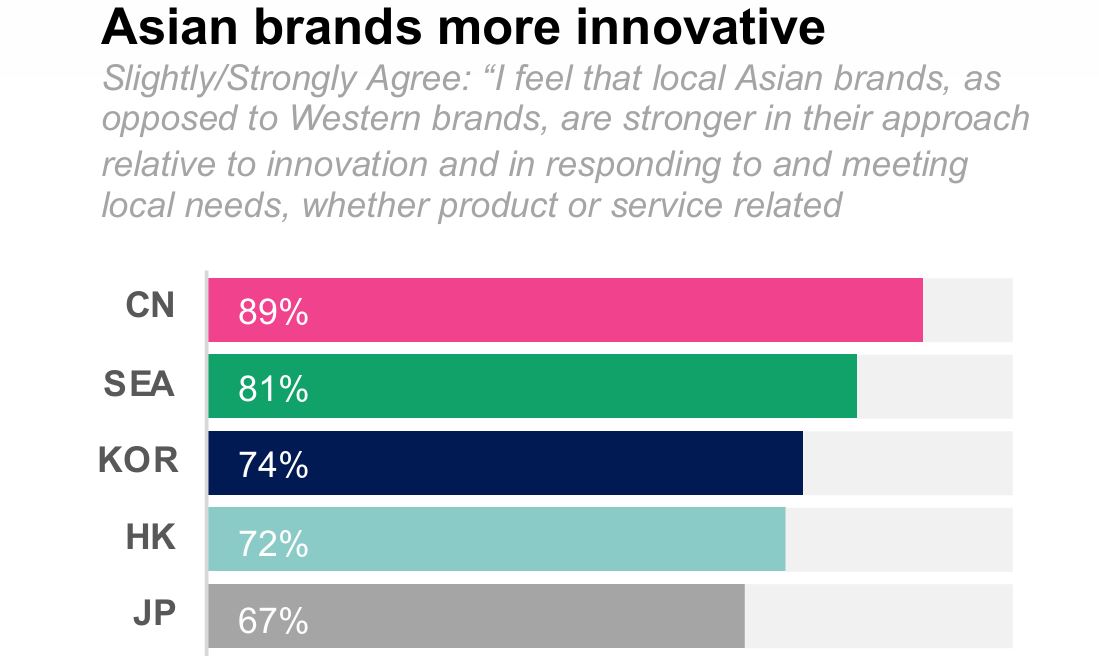

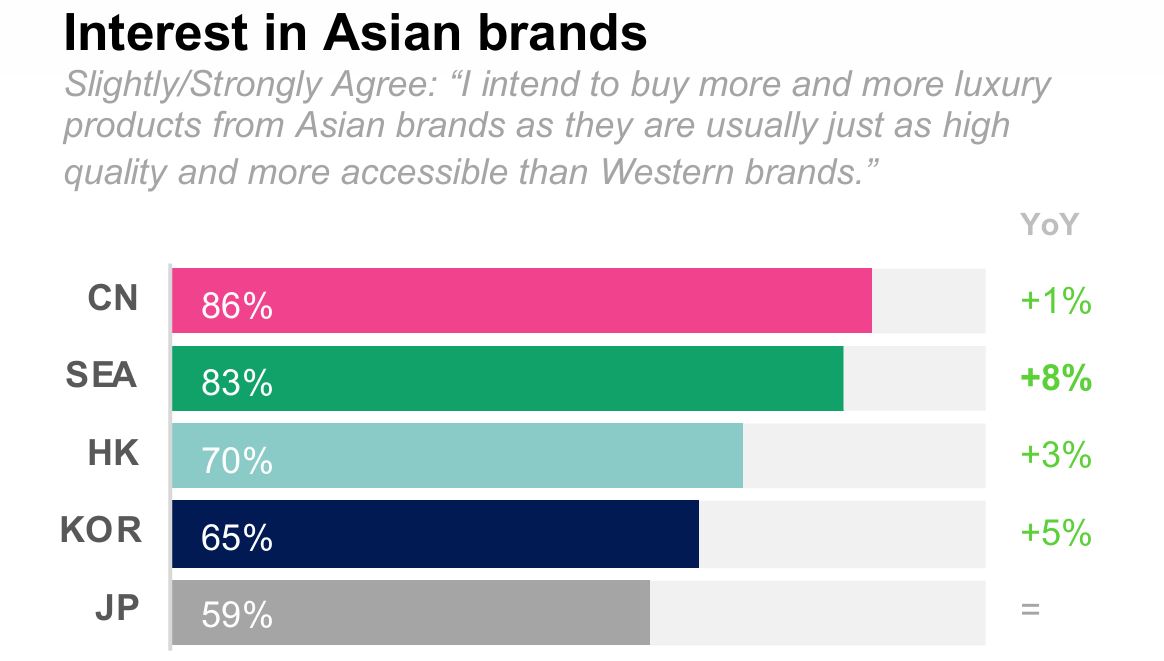

The evolving consumer trends have led to the rise of Asian home-grown and niche brands that blend innovation with cultural relevance and technological expertise.

The data underscores increasing demand for brands that are innovative, emotionally resonant and culturally relevant, with Asian luxury brands enjoying strong appeal, particularly in China (86%), Southeast Asia (83%) and Hong Kong (70%).

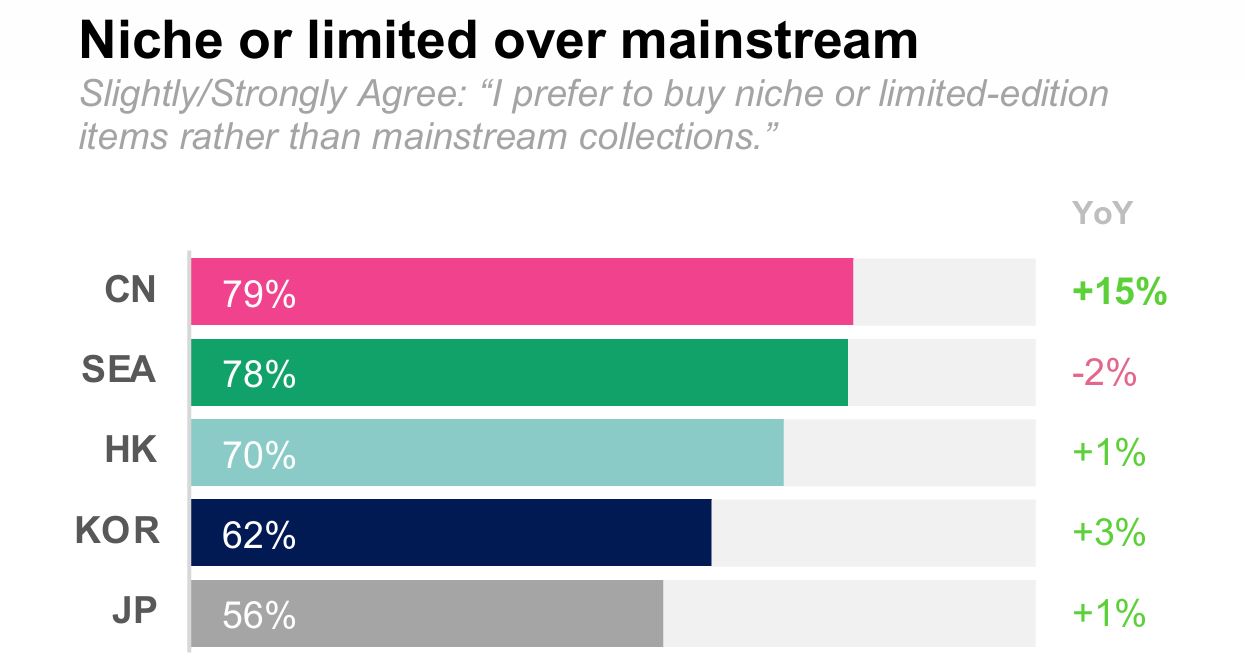

Limited editions and niche collections are outpacing mainstream lines, particularly in China, which recorded a +15pt rise year-on-year. While established luxury houses retain influence, this trend reflects consumer fatigue and rising demand for fresh, differentiated offerings.

Service matters

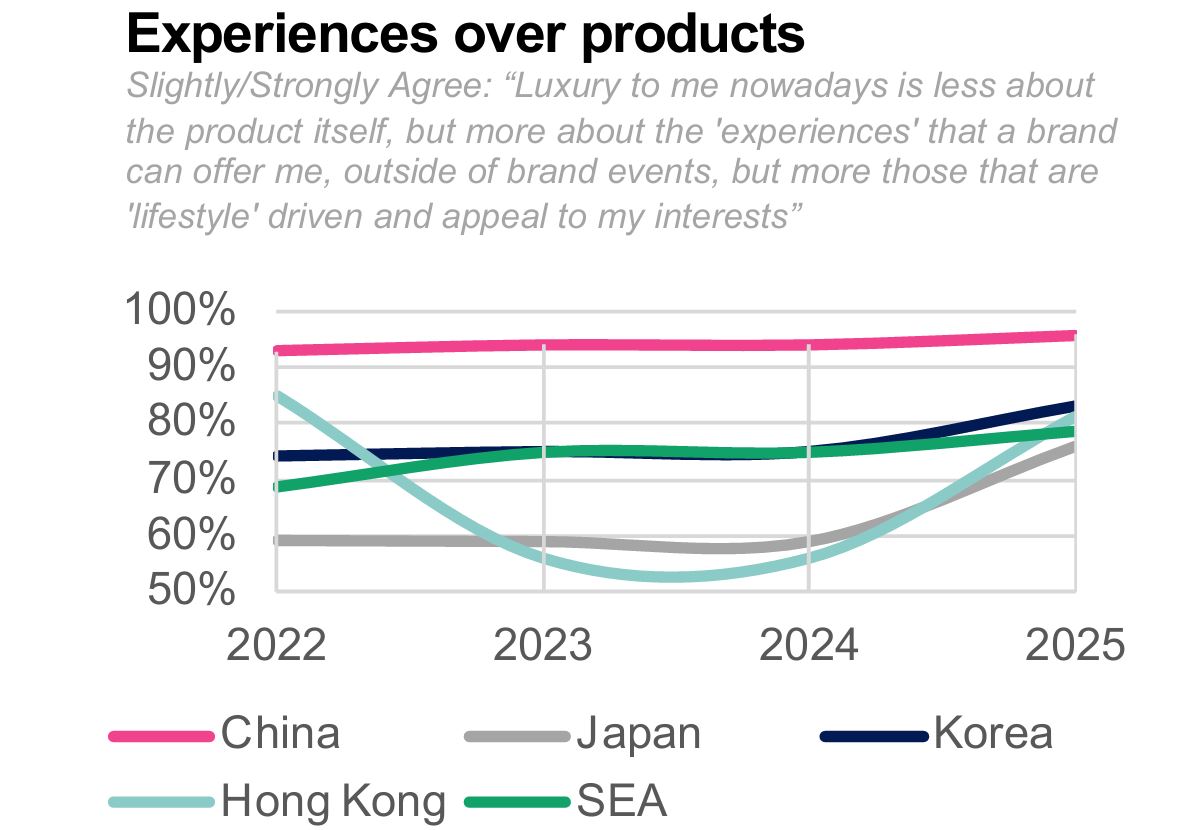

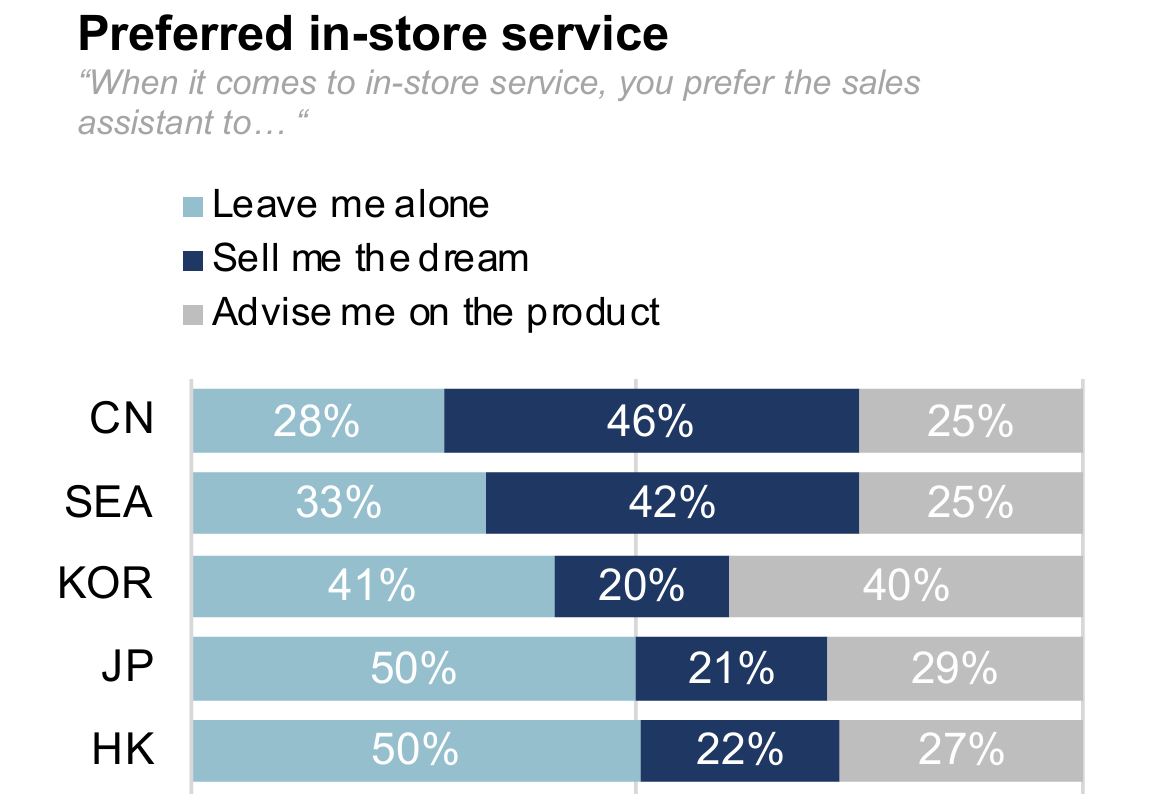

Consumers increasingly expect elevated service standards, with high-touch, seamless interactions now seen as essential, whether online or offline.

Quality service is emerging as the new standard in retail, from personalised digital experiences to knowledgeable in-store staff. Today’s consumers value service that feels “invisible yet attentive, frictionless yet emotionally resonant”.

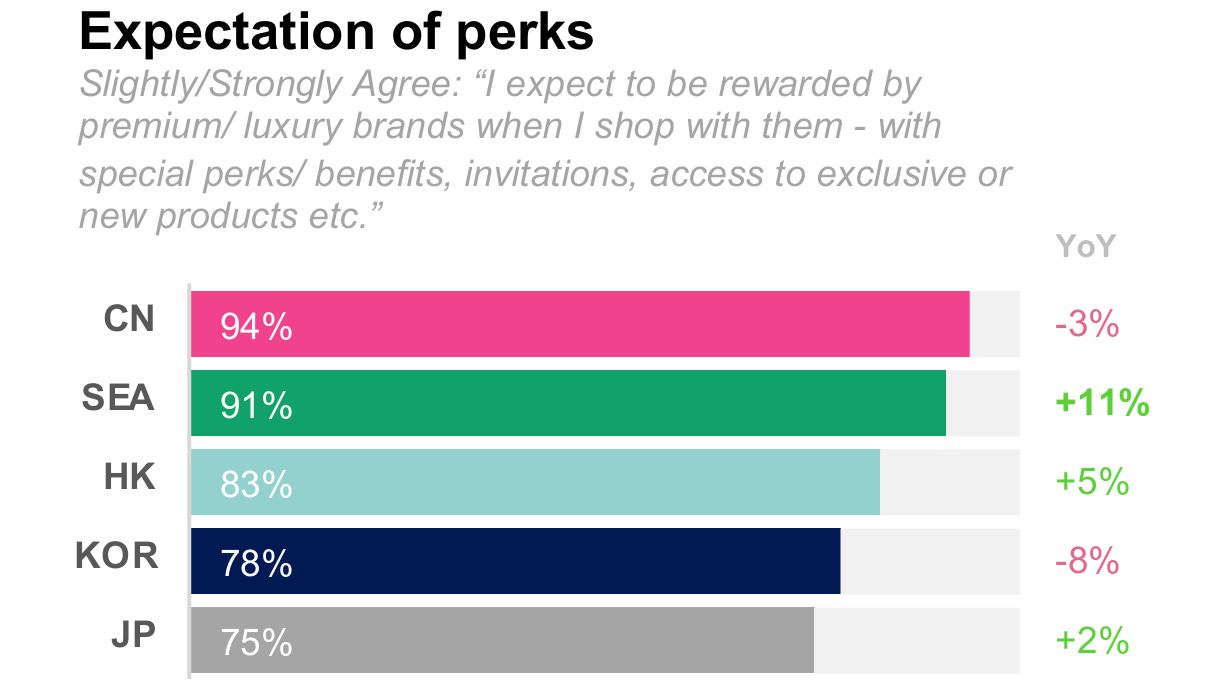

The trend is underscored by over 90% of respondents who expect perks and rewards in luxury retail, alongside growing interest in immersive and personalised in-store experiences, especially in China and Southeast Asia.

This high-touch expectation extends across all product categories and sales channels, suggesting that brands must deliver consistent value not only through their offerings but also through every service touchpoint.

New routes, new travellers

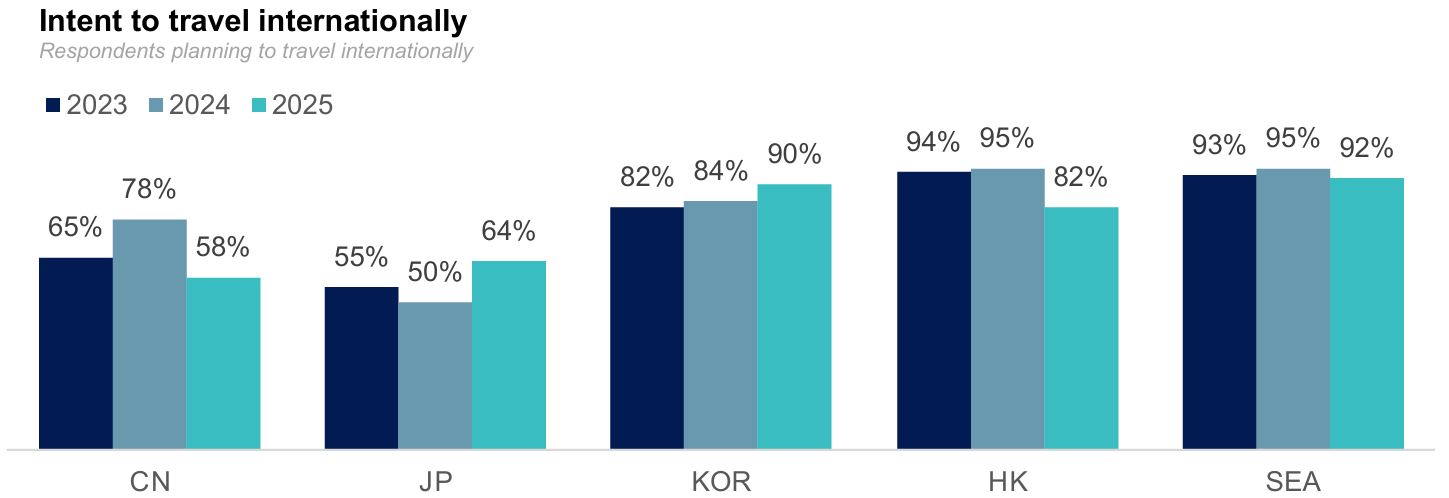

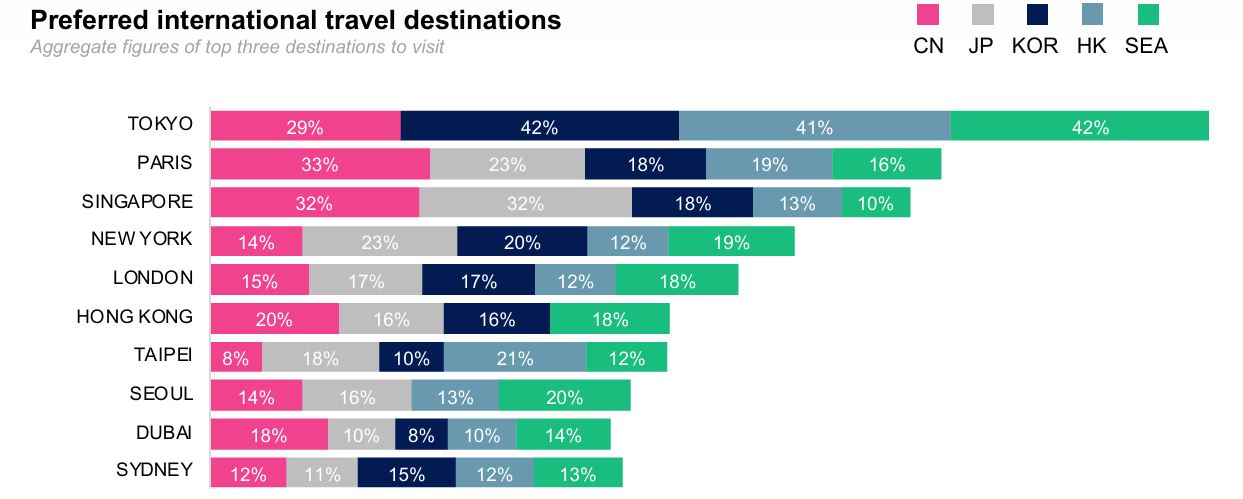

The study highlights a downward trend in outbound Chinese travel intent, with just 58% planning international trips in 2025, compared to 78% in 2024 and 65% in 2023. The shift points to a need for luxury brands to rethink their strategies around outbound Chinese consumer demand.

While China shows signs of softening, outbound travel sentiment remains high in South Korea (90%), Hong Kong (82%) and Southeast Asia (92%).

Dubai and Sydney’s emergence in the top ten most popular destinations underscores a shift in tourism flows and signals fresh retail opportunities.

In conclusion, the 2025 report signals a clear shift – today’s luxury consumer is more thoughtful, digitally aware and expects more than just a product. Brands must respond with locally relevant strategies and consistent value through experiences, service and storytelling.

To download the full report, visit this website.

![‘The Life of Chuck’ – Mike Flanagan & Kate Siegel Spotlight the Horror Stars in Stephen King Movie [Video]](https://bloody-disgusting.com/wp-content/uploads/2025/06/Screenshot-2025-06-12-134913.png)

![‘Yellowjackets’: Christina Ricci Talks Misty Quigley’s Evolution, That Leather Jacket, Her Complicated Walter Bond & The Show’s Shifting Arc [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/06/12125824/Christina-Ricci-Yellowjackets.jpg)

![‘Dying For Sex’: Creators Liz Meriwether & Kim Rosenstock Talk Michelle Williams & Jenny Slate Fearlessness, Sexual Awakenings & The Intimacy Of Showing Up For Friends [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/04/04151935/FXs-Dying-for-Sex-Media-Guide-3.jpg)

-35-45-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-30-7-screenshot_0FxoE4J.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)