Delta and Amex planning to release a super-duper, mega, ultra-premium card?

Chase has been sucking the air out of the blogosphere over the last few days with the announcement of the new Sapphire Reserve Business and “refreshed” Sapphire Reserve cards. Both these cards will look less like utilitarian all-in-one travel cards and more like Amex Platinum-esque coupon books with a $795 yearly price tag. Speaking of […] The post Delta and Amex planning to release a super-duper, mega, ultra-premium card? appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

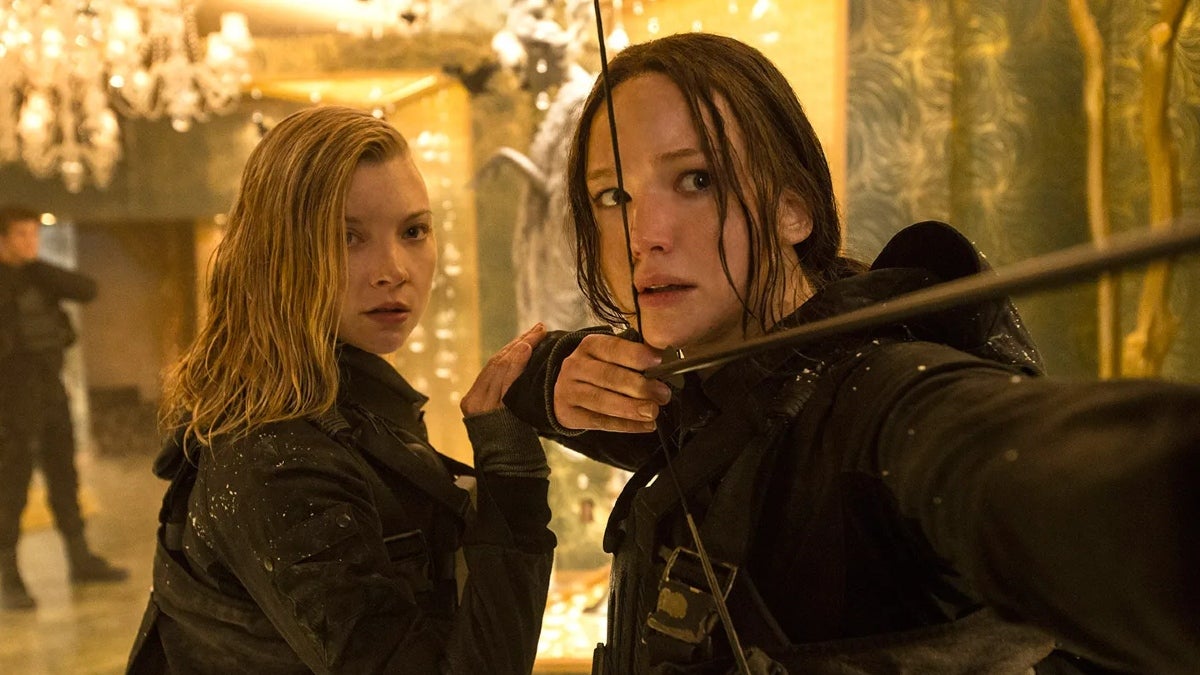

Chase has been sucking the air out of the blogosphere over the last few days with the announcement of the new Sapphire Reserve Business and “refreshed” Sapphire Reserve cards. Both these cards will look less like utilitarian all-in-one travel cards and more like Amex Platinum-esque coupon books with a $795 yearly price tag.

Speaking of Amex, it tried to get a word in edgewise on the Chase-a-thon earlier this week, when it released an announcement that used over five hundred words to say, essentially, “We’re going to redo the Platinum and Business Platinum cards too, but in a few months. Be sure to save some Benjamins.”

Absolutely no one thinks that there won’t be a significant increase in the annual fees once the Platinum cards are refreshed, despite Amex already telling us that one of the Business Platinum’s best features, the 35% rebate on points redemptions towards premium travel, will be going the way of the Sapphire Reserve’s 1.5 cents per point travel redemptions and be kicked to the curb

People in the points and miles world tend to be an opinionated bunch (as the novel-length comments thread on Greg’s Sapphire Reserve post shows), with long and detailed wishlists for the credit card issuers that are obviously hanging on our every word. However, in the midst of all this recent blinginess, one thing that I rarely hear is, “Can we please also have an ultra-premium airline card with a four-figure annual fee and multiple oodles of coupon-like credits?”

Despite that, it sounds like it’s exactly what we’re getting.

Evidently, in addition to the Platinum card refresh, Amex is also planning to add another card to its Delta lineup, positioned above the $650/year Delta Reserve card. View from the Wing reports on a reddit claim that rumors of a new super-duper, stratospherically-premium Delta card are true, and speculates that it might be the first mass market card to break the four-figure annual fee glass diamond ceiling.

Quick Thoughts

Credit card issuers are enamored with the ultra-premium segment, with travel companies and banks falling all over each other to occupy the space. A few years ago, cards with a $500 annual fee seemed like a stretch; now, everyone seems to have one, even when the benefits don’t even pretend to support the cost.

There will undoubtedly be a market for this new Delta card, even with a $1000+ price tag. Delta is currently making ~$7 billion annually from its credit card portfolio (I’ve heard that it also flies planes!?!), and despite adding family rules that attempt to funnel cardholders to higher-priced products, it obviously wants to probe the boundaries of what it can do on the ultra-high end.

The $650 Delta Reserve card no longer provides unlimited SkyClub access. Amex could probably find willing takers for a card that does, then adds some sort of status, a 5,000 Medallion Qualifying Dollar head start, an international or premium cabin companion certificate, and the usual coterie of monthly and quarterly coupon credits. I expect that the card will also have a marble inlay and be studded with diamonds; overpriced metal cards are so 2024, after all.

The post Delta and Amex planning to release a super-duper, mega, ultra-premium card? appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![‘The Descent’ Official Novelization Coming Soon from Titan Books; Read First Chapter Now [Exclusive]](https://bloody-disgusting.com/wp-content/uploads/2020/04/descent-shauna-2.jpg)

![No Stars: A Must-See [THE PLOT AGAINST HARRY]](http://www.jonathanrosenbaum.net/wp-content/uploads/1990/03/ThePlotAgainstHarry-300x168.jpg)

![The Nasty Woody [ANYTHING ELSE]](https://jonathanrosenbaum.net/wp-content/uploads/2011/04/anything-else.gif)

![American Airlines Slammed By Elite Passenger Forced To Fly Economy While Pilots Relax In First Class [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/05/amercan-airlines-737-first-class-seat-pair.jpg?#)

![United Flight Attendant Leaves Risqué Note for Miley Cyrus’ Ex—”I Was Shakin’ Like a Stripper” [Roundup]](https://viewfromthewing.com/wp-content/uploads/2023/02/ua-fa.jpeg?#)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)