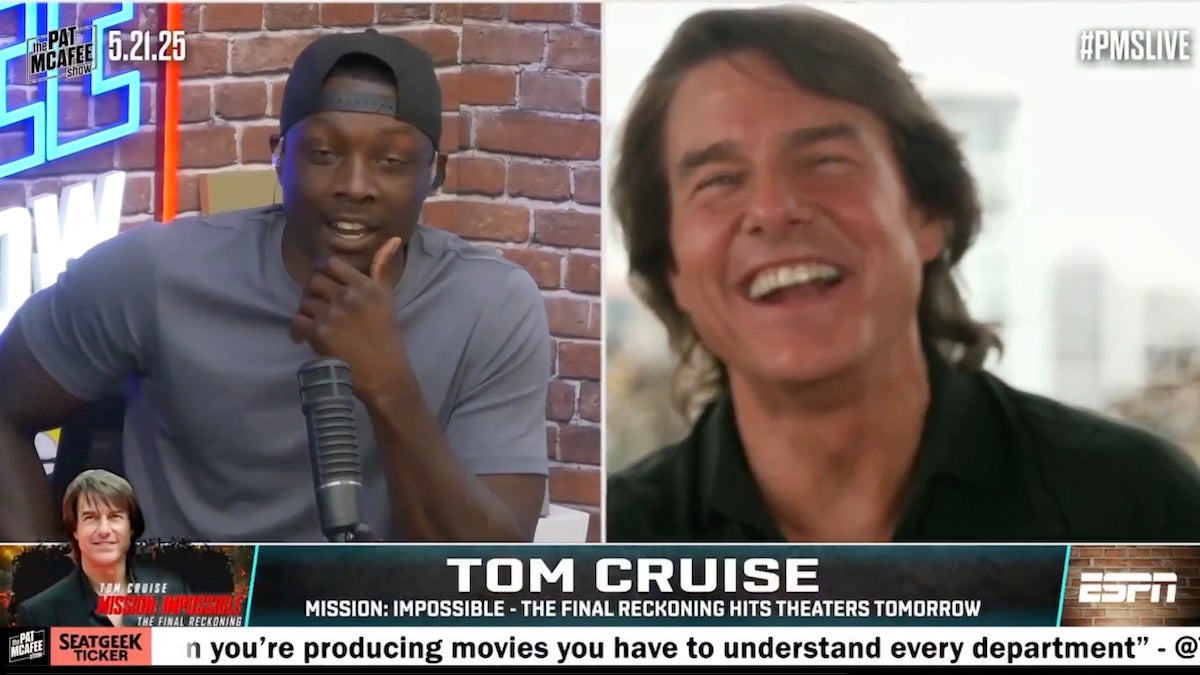

Hot Off the Success of NASCAR and WWE, CW Bosses Are Programming With Sports Viewers in Mind

The network's YA days are long gone as Brad Schwartz and Mike Perman are confident about reaching profitability in 2026 The post Hot Off the Success of NASCAR and WWE, CW Bosses Are Programming With Sports Viewers in Mind appeared first on TheWrap.

Two years ago the CW, fresh off its acquisition by Nexstar, made a proclamation that made the television industry raise a collective eyebrow: the Big Four broadcasters would become the Big Five.

It’s been a long and creatively bloody road since then. Following the 2022 acquisition, the network axed all but one of the young adult originals that used to be synonymous with the brand, leaving behind only “All American.” In place of those generational originals, the network invested heavily in acquired programming, co-productions and sports — lots of sports — all in the hopes of finally making the CW profitable by 2026. As dismissed as the company was initially, Nexstar’s bet seems to be working. By the fourth quarter of 2024, the company reduced its year-over-year losses by $126 million.

“We’ve told people we’re going to be profitable next year. That may be the thing that goes on the top of your resume from now on,” Brad Schwartz, president of entertainment for The CW, told TheWrap.

Much of that success comes from the network’s massive investment in sports, a genre the CW never touched prior to its Nexstar years. Previously, the network offered two hours a night of programming seven days a week, which amounted to about 750 hours per year. Now, the network has increased its overall programming hours to be about 1,100, roughly 40% of which are sports (including the WWE). The network has deals with major brands like ACC and PAC-12 on the college football side and has set viewership records for WWE NXT and NASCAR.

Some of those bets are paying off, the biggest of which is NASCAR. The 2025 NASCAR Xfinity Series season opener at Daytona brought in 1.8 million viewers, making it the most-watched NASCAR Xfinity race since 2022. These races have brought in over 100 partners that have signed on for the 2025 season, including big name brands such as Progressive, Chili’s, Campbell’s, Hellman’s, PNC Bank and Verizon.

“We’re trying to pick things that we think NASCAR viewers will want and that wrestling viewers will want,” Schwartz said. “We’ve gone away from the more young adult scripted to these more adult procedurals, things that are more broadcast friendly, things that are more between the coasts. Doesn’t mean they’re not great, though.”

What started as a proclamation that inspired media outrage and mockery has transformed into a network that is as well-rounded as any of its broadcast peers. And according to Schwartz and senior vice president of sports for the CW Mike Perman, this is just the beginning.

“Now we have a little bit of wind in our sails. We’re obviously the smallest, so it’s easier to have bigger percentage growth,” Schwartz said. “This is probably the hardest thing I’ve ever done in my career. But I’m doing it with great people at a great big company that, depending on how things go in the next couple of years, could see some real growth.”

TheWrap spoke with Schwartz and Perman about approaching broadcasting at the local level, the future of “All American” and the network’s content co-productions experiment.

TheWrap: I know that you’ve brought on a lot more advertisers because of live sports. Do you anticipate that those numbers will increase in 2025?

Brad Schwartz: Yes. The success of NASCAR has really pushed us into a whole new ball game. We’ve now had 11 straight races that have all been over a million viewers. It’s the No. 1 show on the CW. It’s exceeding any of our expectations. Not only that but these XFINITY races are up 28% from a year ago. By putting all 33 XFINITY races on one network, it allowed us to invest in and build the series because it’s ours for the next seven years.

It’s the biggest priority for us. Nexstar promoted this thing across all 200 stations — not just the CW stations, but their Fox stations and NBC stations. So there’s a big marketing push, a great new original production, big prioritization, and we’ve seen it work. That has translated into advertisers being like, “Oh my God, that’s incredible consistency.” Our brand partnership team is integrating tons of brands and clients into the show, not just running 30 second ads. At Talladega, we had 15 advertisers doing over 30 different integrations within the show.

Advertisers are really starting to come and come big to us because they see how we’re delivering. It’s been a really big surprise, but it’s been great. So yes, that’s going to keep going up. Our CPMs [cost per thousand] on sports are going up, so it’s good. We’re over-delivering what we promised.

Mike Perman: We’ve also seen higher demand. We added two ACC basketball games because we had such demand for advertisers that wanted to work with us that we needed the space to put them.

As you’ve been doing more of these integrations, they’re a little bit more ambitious than a typical advertising spot. What have you learned by doing them? Is this a direction you want to explore more?

Schwartz: Yeah. It’s this whole strategy of ours to impact locally and to strengthen our local stations. When we can get into a market and put the CW van up or do an integration, like at Talladega or Daytona, it just gets us closer to the consumer, closer to the viewers. It helps build the brand of that local station in that market, which strengthens the CW. I always like to say that we like impacting locally, and then we like the reach of national.

People don’t just want to run 30-second spots. They want to be integrated with the fans. And we’re still this small, nimble, competitor brand to everybody else, so we fight hard for it. We go above and beyond because we have to, because we’re not CBS, we’re not NBC. We’re a little bit of a challenger brand.

I do know that our local affiliates are over the moon about having NASCAR and WWE. They keep asking for more sports because it’s just delivering, not just big numbers, but new viewers coming to the CW.

One of the reasons I enjoy covering the CW is it seems as other networks don’t seem as invested in their local markets, and you guys are all-in on local. What have you learned from focusing on these markets?

Schwartz: Unlike all the other broadcasters, this is a company that owns 200 plus local stations. That’s their business. It’s all they do. And when they bought the CW, they were able to add a national platform on top of what was really 200 local businesses. The little spin line that we like to use is now the CW is broadcasting in the hands of broadcasters. All our bosses think about is how to make these local stations better. I don’t know if CBS or NBC think that way. They think about making the network. Everyone leans where they’re most comfortable.

“All American” is wrapping up its latest season. What does its future look like?

Schwartz: This season of “All American” kind of rebooted itself with a new cast and some of the old cast, and every week this season, it’s been growing. You never know how a new cast is going to be; you never know how it’s going to hit. But it’s been really working. And [Nkechi Okoro Carroll], who is the showrunner of that show, is just brilliant. We are in active discussions with WBTV about what to do. I can’t put a percentage on the chances of it continuing or not continuing, but it’d be great to get one more season out of it.

Also on the content side, I know that you have lots of different relationships including co-productions and acquisitions. As you’ve been experimenting, what have you found works the best?

Schwartz: We’re spending a lot of money on sports. That money has to come from somewhere. Our sports business is helping us with our distribution conversations and negotiations. So sports is doing its job, but we still have seven nights a week of programming to fill. We still have a digital business that needs on-demand streaming content like “All American” and “Wild Cards.”

So it’s a mix. There’s some great unscripted content that we can create some volume with. We did a show called “Police 24/7.” We did 12 episodes, and it really worked, so we did 50. We have a show from the producers of “America’s Funniest Home Videos” called “Totally Funny Animals.” It worked; we made 100 new episodes. The game shows were really great. These are shows that you can make in volume that could eventually go into syndication on Nexstar stations. So there’s a business there of creating this high volume, unscripted programming that feels very broadcast.

Then scripted is this shiny premium product that keeps CPMs high. It keeps premium advertisers in our world, advertisers that might not want sports or unscripted. There are advertisers out there that want premium scripted things, and so we have “All American,” “Wild Cards” and “Good Cop/Bad Cop.” We have “Sherlock & Daughter,” which is actually bigger than “Wild Cards,” and it just premiered. And “Wild Cards” is our biggest show.

So we have a Tuesday night now that is always wrestling. We have a Wednesday night now that is always scripted. We have a Thursday night that’s game shows. We have a Friday night that’s “Penn and Teller.” Saturdays is a lot of sports. We’re building these different flavors. Hopefully, sports brings a bunch of new viewers in, and then we can kind of push them around. But that’s the mix. It can’t all be scripted. It also can’t all be unscripted, and it can’t all be sports. We’re trying to pick things that we think NASCAR viewers will want and that wrestling viewers will want. We’ve gone away from the more young adult scripted to these more adult procedurals, things that are more broadcast friendly, things that are more between the coasts. Doesn’t mean they’re not great, though.

Do you still see 2026 is when you guys are going to hit profitability?

Schwartz: Yep.

This interview has been edited for length and clarity.

The post Hot Off the Success of NASCAR and WWE, CW Bosses Are Programming With Sports Viewers in Mind appeared first on TheWrap.

![Fascinating Rhythms [M]](https://jonathanrosenbaum.net/wp-content/uploads/2011/04/m-fingerprint.jpg)

![Love and Politics [THE RUSSIA HOUSE & HAVANA]](https://jonathanrosenbaum.net/wp-content/uploads/2011/12/therussiahouse-big-300x239.jpg)

![‘Friendship’: Andrew DeYoung On Tim Robinson, Paul Rudd, & The Wildest, Cringiest Buddy Comedy Of The Year [The Discourse Podcast]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/22133754/FRIENDSHIP-Poster.jpg)

![They Flew $19,000 Business Class—Here’s What I Think Denver Airport Execs Were Really Doing [Roundup]](https://viewfromthewing.com/wp-content/uploads/2015/10/Denver_international_airport.jpg?#)

-1-52-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Making Brands Relevant: How to Connect Culture, Creativity & Commerce with Cyril Louis](https://justcreative.com/wp-content/uploads/2025/05/cyril-lewis-podcast-29.png)