TerraPay urges small travel firms to adopt virtual cards

Recommendations from payment provider TerraPay on optimizing your payment setup - especially if you are a small property owner navigating international transactions. The article TerraPay urges small travel firms to adopt virtual cards first appeared in TravelDailyNews International.

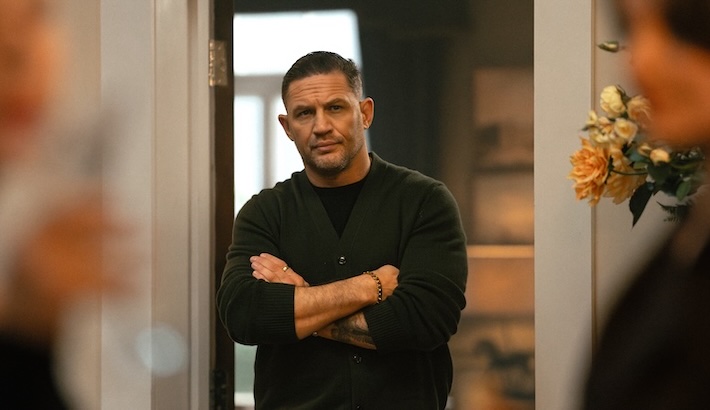

BARCELONA – Ahead of next week’s Bavel Summit by Voxel in Barcelona, payment provider TerraPay is urging the 35% of travel businesses – especially small and single-property operators – that currently don’t accept virtual cards to reconsider their payment strategies.

The company warns that outdated systems and reliance on traditional banking are putting many operators at a disadvantage position in the rapidly evolving digital marketplace.

Koert Grasveld, Vice President of Travel Payments at TerraPay, says: “Small property owners often struggle with managing international payments due to limited access to advanced digital tools and the high costs associated with traditional banking systems.

“These challenges include slow transaction times, high fees, and complex processes that hinder cash flow and create barriers to competing effectively on a global scale. For many small-scale operators – especially those managing just one or a few properties – these inefficiencies can significantly impact their ability to capture and serve international guests smoothly.”

Grasveld points to virtual cards and other modern payment tools as a viable alternative that can simplify cross-border transactions and reduce dependence on legacy infrastructure. “These platforms enable instant, secure, and cost-effective transfers, often bypassing intermediaries that add delays and extra costs,” he said. And adds: “By adopting virtual payments, small property owners can streamline financial operations, improve cash flow management, and unlock new opportunities to grow in an increasingly global and digital travel economy.”

Despite the growing shift toward digital transactions, many small hotel and boutique property managers still rely on slow and costly SWIFT-based systems. This creates friction and operational delays that disproportionately affect smaller players – especially in regions where virtual card infrastructure is underdeveloped or nonexistent.

Grasveld explains that this gap can be bridged by offering a more streamlined cross-border payment solution – one that reduces fees, shortens settlement times, and improves accessibility. This is particularly crucial in regions where mobile wallets have leapfrogged traditional banks, and businesses need more agile, tech-enabled solutions to stay competitive.

In markets like Asia, where many individuals and businesses do not have bank accounts but rely heavily on mobile wallets, integrating directly with local financial ecosystems allows providers like TerraPay to eliminate traditional intermediaries and deliver fast, secure transfers – with no bank account required.

The same technology is also enabling airlines and online travel agencies (OTAs) to deliver instant payouts to travelers to cover urgent expenses such as food and drinks or hotel accommodation – without the delays or limitations of traditional card-based systems.

As the travel sector continues to digitalize, embracing flexible, secure, and scalable payment tools is becoming a necessity. TerraPay’s message ahead of the Bavel Summit is clear: the industry – especially its smallest players – can’t afford to be left behind.

The article TerraPay urges small travel firms to adopt virtual cards first appeared in TravelDailyNews International.

![Fascinating Rhythms [M]](https://jonathanrosenbaum.net/wp-content/uploads/2011/04/m-fingerprint.jpg)

![Love and Politics [THE RUSSIA HOUSE & HAVANA]](https://jonathanrosenbaum.net/wp-content/uploads/2011/12/therussiahouse-big-300x239.jpg)

![‘Friendship’: Andrew DeYoung On Tim Robinson, Paul Rudd, & The Wildest, Cringiest Buddy Comedy Of The Year [The Discourse Podcast]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/22133754/FRIENDSHIP-Poster.jpg)

![They Flew $19,000 Business Class—Here’s What I Think Denver Airport Execs Were Really Doing [Roundup]](https://viewfromthewing.com/wp-content/uploads/2015/10/Denver_international_airport.jpg?#)

-1-52-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Making Brands Relevant: How to Connect Culture, Creativity & Commerce with Cyril Louis](https://justcreative.com/wp-content/uploads/2025/05/cyril-lewis-podcast-29.png)