Coty stock eases after spike prompted by WWD report of potential sale

Coty’s share price eased -2.18% yesterday (17 June) to US$4.94 after a sharp spike on Monday (16 June) following a WWD report that the group is seeking buyers for its luxury and consumer beauty businesses.

Coty’s share price eased -2.18% yesterday (17 June) to US$4.94 after a sharp spike on Monday (16 June) following a WWD report that the group is seeking buyers for its luxury and consumer beauty businesses.

Coty stock jumped +7% in afternoon trading on the New York Stock Exchange after the report, closing at US$5.05, up +6.7% over the previous day.

The share price was down -29.3% for the past six months at close of trading yesterday.

In a comment to The Moodie Davitt Report, a Coty spokesperson said: “As a matter of principle, we do not comment on rumour and speculation.”

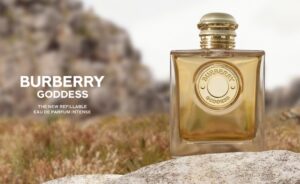

The WWD story suggested potential divestment would separate Coty’s prestige fragrance and beauty brands – which include Gucci, Burberry, Jil Sander and Hugo Boss – from its mass-market portfolio comprising Covergirl, Rimmel London and Max Factor.

According to WWD, Coty is in discussions with Interparfums regarding the sale of parts of its luxury division, with particular interest focused on the high-performing Burberry and Hugo Boss fragrance lines. Interparfums previously held the Burberry fragrance licence until 2013.

![“[You] Build a Movie Like You Build a Fire”: Lost Highway DP Peter Deming on Restorations, Lighting and Working with David Lynch](https://filmmakermagazine.com/wp-content/uploads/2025/03/1152_image_03-628x348.jpg)

![The Most Intelligent American Movie of the Year [THE BIG RED ONE: THE RECONSTRUCTION]](https://jonathanrosenbaum.net/wp-content/uploads/2011/12/the-big-red-one2.jpg)

![Cinematic Obsessions [THE GANG OF FOUR and SANTA SANGRE]](https://jonathanrosenbaum.net/wp-content/uploads/2010/12/labandedesquartre.jpg)

![Reinventing the Present [10]](https://jonathanrosenbaum.net/wp-content/uploads/2011/05/10-driver3.jpg)

![‘Inside’ Review: Guy Pearce & Ed Cosmo Jarvis Elevate A Standard-Issue Aussie Prison Drama [Tribeca]](https://cdn.theplaylist.net/wp-content/uploads/2025/06/16154955/Inside-Guy-Pearce.jpg)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)