Immersive experiences and digital convenience drive Chinese outbound travel, finds iClick report

iClick Interactive has published the Chinese Luxury Travelers Whitepaper 2025, offering key insights into the evolving behaviour of China’s high-spending outbound travellers.

Online marketing and data cloud platform iClick Interactive has published the 2025 Chinese Luxury Travelers Whitepaper, offering key insights into the evolving behaviour of China’s high-spending outbound travellers.

The report – produced in partnership with online travel agency Ctrip and a leading Chinese payment provider – provides luxury brands and marketers with data-driven analysis and strategic guidance to better connect with Chinese travellers in the post-pandemic era.

As China’s outbound tourism rebounds, the whitepaper examines luxury consumption trends, the growing influence of Gen Z, and the rising importance of digital platforms and cross-border ecommerce in shaping travel decisions.

Outbound travel reshapes luxury retail

Before the pandemic, Chinese consumers made 60% of their luxury purchases overseas, amounting to RMB717.6 billion (US$98.98 billion) in 2019 [sources: Business of Fashion; Statista].

COVID-19 border restrictions redirected much of that spending to domestic destinations, particularly Hainan, which emerged as a retail hotspot.

However, with outbound travel resuming in 2023, daigous have returned to international markets in search of lower prices, while government crackdowns and regional incentives – especially in destinations such as Japan – have contributed to a -29.3% year-on-year decline in Hainan’s luxury sales in 2024 [source: Vogue Business].

In response, luxury brands are expanding into other major Chinese cities as well as smaller and rural markets (also called the ‘sinking market’) to drive growth.

Where Chinese travellers are going – and why

The whitepaper notes that international air traffic from China recovered to 78% of 2019 levels in the first quarter of 2024, with flight volumes during the May Day holiday surpassing pre-pandemic volumes [source: China Trading Desk].

Chinese outbound travel spending reached RMB1.42 trillion (US$196.5 billion) in 2023, compared to RMB1.85 trillion (US$254.6 billion) in 2019 [source: Statista].

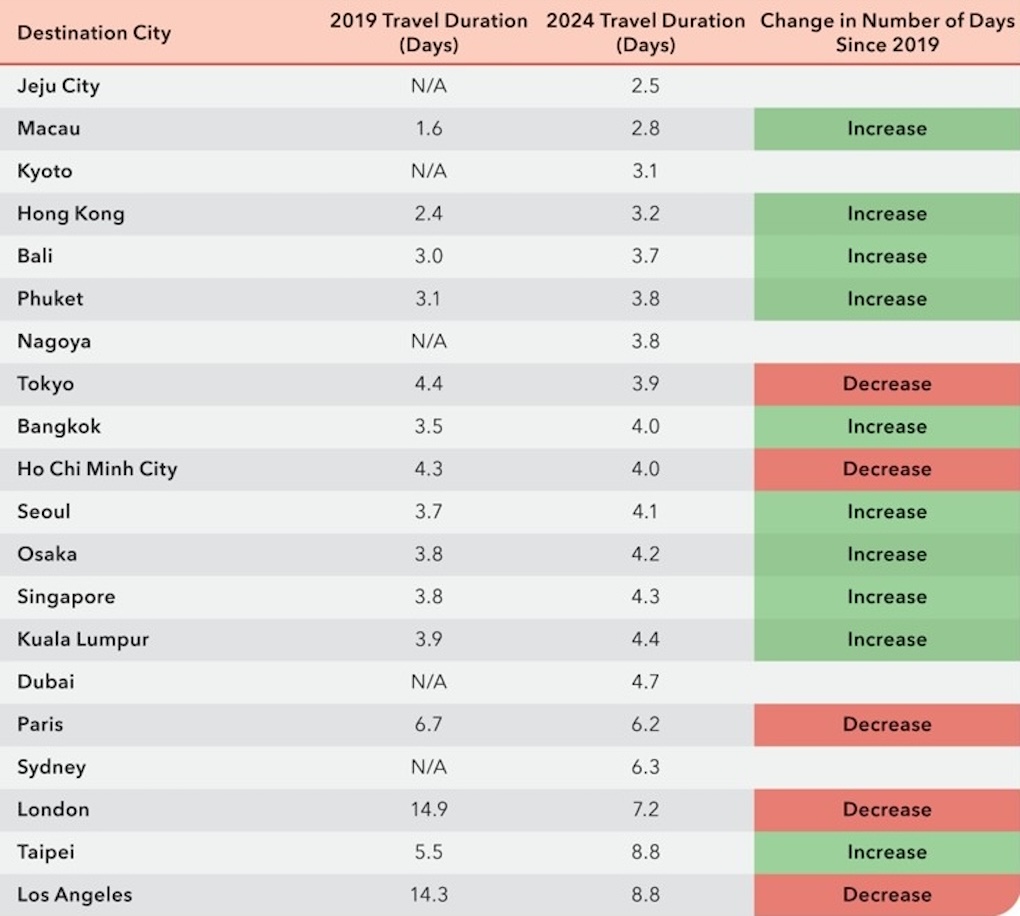

Top destinations for Chinese high-spending outbound travellers in 2024 are concentrated in Asia, including Hong Kong, Tokyo and Bangkok.

Destinations such as Kyoto, Jeju, Dubai, Sydney and Nagoya are also gaining popularity, particularly for nature-based activities, cultural experiences and large-scale events, including concerts and the Paris Olympics [source: Ctrip 2024 Travel Data Report].

At the same time, booking behaviour has changed, with only 17% of short-distance flights booked 30+ days in advance in 2024, down from 24% in 2019, reflecting greater flexibility due to visa delays and flight uncertainties [source: China Trading Desk].

The report also highlights an increase in average trip durations to destinations such as Hong Kong, Macau, Bali and Seoul, with decreases seen in cities such as London and Los Angeles.

Additionally, Gen Z is emerging as a key driver of China’s outbound travel rebound. This tech-savvy demographic favours spontaneous, independent trips and affordable regional destinations.

Platforms such as Douyin and Xiaohongshu (RedNote) are central to their travel planning, with a strong emphasis on immersive experiences.

Content, commerce and conversion

Digital platforms remain central to the travel decision-making process for Chinese consumers.

Online travel agencies, including Ctrip, Qunar, Fliggy and Tongcheng, dominate trip planning, while platforms such as WeChat, Douyin and Xiaohongshu integrate content, community and commerce to influence purchase decisions.

Xiaohongshu recorded over 300 million monthly active users as of August 2024, while Douyin is increasingly being used by duty-free retailers and luxury brands to engage customers through livestreaming and key opinion leader collaborations.

2025 Chinese Luxury Travelers Whitepaper emphasises how iClick collaborates with a wide range of premium data partners to help brands reach high-value travellers through tailored digital strategies.

It outlines how luxury brands can optimise product visibility and drive engagement and sales across multiple digital channels.

The report also explores the growing importance of cross-border ecommerce and digital payments in the duty-free sector. Alipay and WeChat Pay remain essential tools for outbound Chinese travellers, shaping where and how they shop during trips abroad.

The report also explores the growing importance of cross-border ecommerce and digital payments in the duty-free sector. Alipay and WeChat Pay remain essential tools for outbound Chinese travellers, shaping where and how they shop during trips abroad.

A featured case study highlights the collaboration between CDF-Sunrise Duty Free and Alipay, showcasing how digital payment platforms enhance convenience and influence consumer preferences.

2025 Chinese Luxury Travelers Whitepaper highlights key luxury travel trends for 2025

1. Digital payments: Platforms such as Alipay and WeChat Pay continue to influence travel decisions and spending habits for outbound travellers.

2. Preferred destinations: High-spending travellers are expected to favour Asia Pacific destinations, such as Japan and Thailand, as well as European destinations, including France and Italy. By 2025, 75% are projected to travel for more than five days.

3. Cultural immersion: Travellers are showing increased interest in local cuisine, nature-based experiences and niche tourism tailored to personal interests.

4. Sustainability: While interest in eco-friendly travel is growing, many consumers view environmental responsibility as the role of governments and industry – and thus remain reluctant to pay extra for sustainable options.

5. Airport retail: More international airports are seeing an uptick in Chinese luxury shoppers, prompting brands to offer premium, targeted experiences.

6. Digital nomadism: The rise of remote work is encouraging longer international stays, particularly in destinations catering to flexible, mobile lifestyles.

All images courtesy iClick Interactive

![Kick Your Way Out of Hell in ‘Kick’n Hell’ on July 21 [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/05/kicknhell.jpg)

![Love and Politics [THE RUSSIA HOUSE & HAVANA]](https://jonathanrosenbaum.net/wp-content/uploads/2011/12/therussiahouse-big-300x239.jpg)

![The Screed We Need [FAHRENHEIT 9/11]](https://jonathanrosenbaum.net/wp-content/uploads/2011/11/fahrenheit_9-11_collage.jpg)

![‘The Studio’: Co-Creator Alex Gregory Talks Hollywood Satire, Seth Rogen’s Pratfalls, Scorsese’s Secret Comedy Genius, & More [Bingeworthy Podcast]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/22130104/The_Studio_Photo_010705.jpg)

![‘Romeria’ Review: Carla Simón’s Poetic Portrait Of A Family Trying To Forget [Cannes]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/22133432/Romeria2.jpg)

![‘Resurrection’ Review: Bi Gan’s Sci-Fi Epic Is A Wondrous & Expansive Dream Of Pure Cinema [Cannes]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/22162152/KUANG-YE-SHI-DAI-BI-Gan-Resurrection.jpg)

.jpg?#)

.png?#)

![[Podcast] Making Brands Relevant: How to Connect Culture, Creativity & Commerce with Cyril Louis](https://justcreative.com/wp-content/uploads/2025/05/cyril-lewis-podcast-29.png)