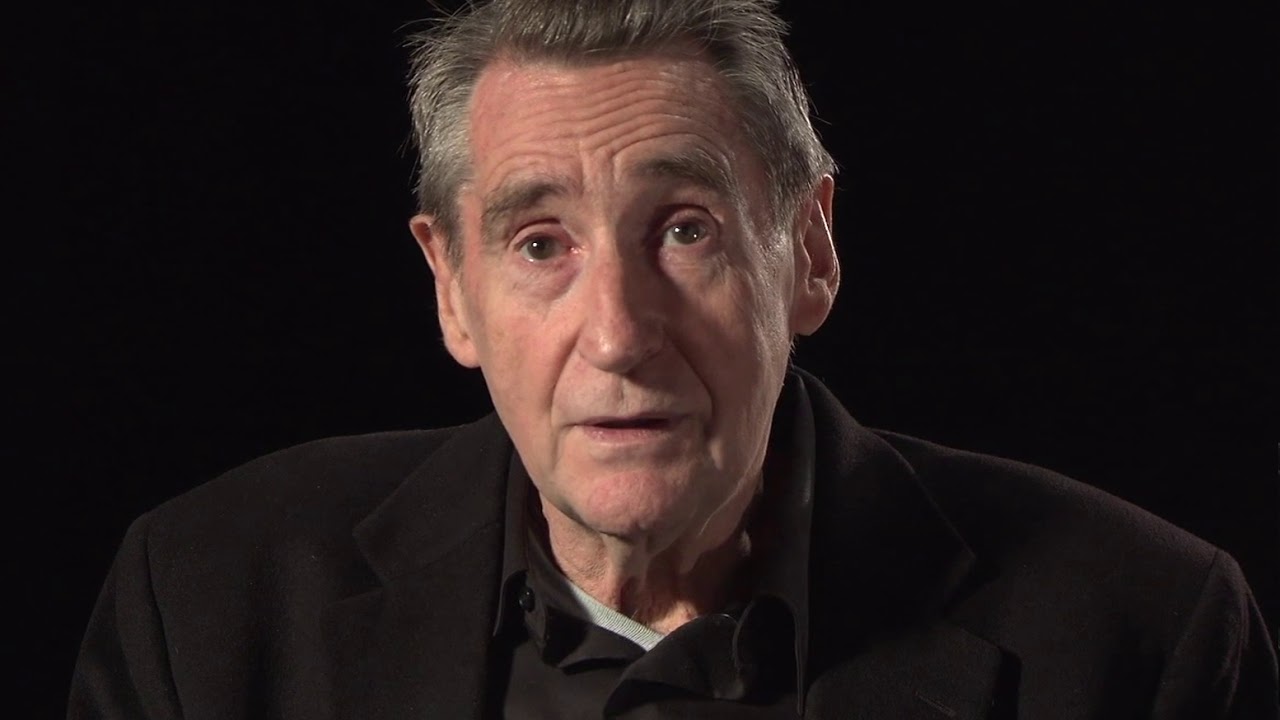

Geopolitical shifts and the future of European aviation: Insights from Marc De Vos at ACI Europe 2025

Marc De Vos delivered a strategic analysis at ACI Europe 2025, emphasizing how geopolitical realignment and economic fragmentation will redefine aviation, trade, investment, and airport development across Europe. The article Geopolitical shifts and the future of European aviation: Insights from Marc De Vos at ACI Europe 2025 first appeared in TravelDailyNews International.

Geopolitical shifts and European aviation were central themes in the keynote delivered by Marc De Vos, Co-Chief Executive Officer of the Itinera Institute, during the opening of the ACI Europe Annual Congress & General Assembly 2025 in Athens. Offering a macro-strategic perspective, De Vos provided a compelling overview of how political, economic, and security transformations are shaping the future of European aviation—and why the industry must prepare for a fundamentally altered landscape.

The end of globalization and the return of state-led economics

De Vos argued that the age of globalization, underpinned by trust, free trade, and multilateral norms, has given way to an era of strategic competition. According to him, aviation is entering a period not of temporary turbulence, but of structural volatility. Governments are increasingly exercising geo-economic statecraft—intervening in markets, reasserting industrial policies, and aligning trade with national security interests.

Under these conditions, international trade is no longer value-neutral or purely profit-driven. It reflects broader geopolitical alliances. “We will trade not just for commerce, but for trust and strategic alignment,” said De Vos. This trend carries major implications for European aviation, which depends on open skies, international investment, and a predictable regulatory environment.

Europe caught between fragmentation and leadership

De Vos described Europe as strategically isolated in the emerging world order. With the U.S. retrenching and global institutions weakened, the EU must balance its foundational ideals—norms, cooperation, and rules-based governance—with the need for autonomy and resilience. Brussels, he noted, faces a “collective action problem”: limited centralized power, lack of fiscal capacity, and the complexity of achieving consensus among 27 member states.

He compared the current shift in European industrial policy to the long-standing Chinese model—centralized, long-term planning with national security at its core. However, unlike Beijing or Washington, Brussels lacks the unified instruments to execute such a vision quickly and effectively.

US-China rivalry and its aviation implications

In his address, De Vos drew parallels between the geopolitical behavior of Donald Trump’s America and that of China: both nations increasingly use trade as leverage, impose unilateral tariffs, and prioritize self-sufficiency. This rivalry accelerates the fragmentation of global supply chains and transportation flows, which has a ripple effect on European aviation hubs.

For airport operators and airlines, this means shifting traffic patterns, new bilateral trade zones, and possibly the politicization of route development and airport expansion.

“Who becomes a strategic aviation hub may no longer depend on market efficiency alone,” he said. “It may depend on alignment with geopolitical priorities.”

Strategic autonomy and the future of the EU aviation ecosystem

Geopolitical shifts and European aviation intersect most critically in the EU’s push for strategic autonomy. De Vos outlined how Europe is actively designing multi-year plans across sectors—energy, data, defense, and possibly aviation—with goals of building sufficient production capacity and technological leadership on EU soil.

He stressed the importance of integrating aviation infrastructure and air transport into these plans, highlighting dual-use potential (civil and military) for airport assets. A growing emphasis on cybersecurity, data sovereignty, and secure logistics corridors—including NATO-coordinated infrastructure—will place new expectations on airport operators, from digital systems to runway specifications.

A call to rethink aviation through a security and resilience lens

De Vos concluded by urging the aviation sector to adopt a broader lens—one that includes security, defense, and geopolitical positioning.

“Airports and airlines are no longer just civil infrastructure. They are becoming instruments of strategic policy,” he said.

This shift may result in:

- Increased government investment in aviation for strategic readiness

- New business opportunities for airports serving defense logistics

- Reprioritization of international partnerships based on security alignment

- Complex regulatory environments tied to trade origin, data protocols, and resilience standards

The biggest risk, according to De Vos, is not adaptation but inertia.

“Europe has mobilized, but we must accelerate,” he said. “Aviation must position itself within this reality—not apart from it.”

Navigating the unknown: Next steps for aviation professionals

In a fragmented world with overlapping crises—conflict, climate, trade, and technology—the aviation industry must prepare for a long-term transformation. As geopolitical shifts and European aviation grow increasingly interlinked, collaboration across sectors, strong policy coordination, and strategic foresight will become prerequisites for sustainable growth.

Marc De Vos’s intervention at ACI Europe 2025 thus serves as a wake-up call for aviation professionals to embed geopolitical analysis into their long-term planning. The rules of global engagement are being rewritten—and aviation must ensure it remains not just resilient, but relevant.

The article Geopolitical shifts and the future of European aviation: Insights from Marc De Vos at ACI Europe 2025 first appeared in TravelDailyNews International.

![‘Buckshot Roulette’ Developer Announces Psychological Horror Title ‘s.p.l.i.t’ Launches July 24 [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/06/split.jpg)

![Puppets, Zombies and Aliens Run Amok in ‘Apocalypse Love’ [Review]](https://bloody-disgusting.com/wp-content/uploads/2025/06/Apocalypse-Love-2.png)

![‘The House of the Dead 2: Remake’ Comes to Switch and PC on August 7 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/06/hotd2.jpg?fit=900%2C580&ssl=1)

![The Nasty Woody [ANYTHING ELSE]](https://jonathanrosenbaum.net/wp-content/uploads/2011/04/anything-else.gif)

![Satire in Action [15 MINUTES]](https://jonathanrosenbaum.net/wp-content/uploads/2011/11/15minutes.jpg)

![Strangers in Elvisland [MYSTERY TRAIN]](https://jonathanrosenbaum.net/wp-content/uploads/2011/04/mysterytrain-theaterruin.jpg)

![United Flight Attendant Leaves Risqué Note for Miley Cyrus’ Ex—”I Was Shakin’ Like a Stripper” [Roundup]](https://viewfromthewing.com/wp-content/uploads/2023/02/ua-fa.jpeg?#)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)