California Assembly Passes Film Tax Bill to Expand Production Incentives

Wednesday's 73-1 vote comes a day after the state senate passed a similar bill, both without a proposed increase to cap the program at $750 million The post California Assembly Passes Film Tax Bill to Expand Production Incentives appeared first on TheWrap.

The California State Assembly has overwhelmingly passed a bill that would overhaul the state’s production tax incentive program, a key step in legislators’ efforts to provide support to struggling Hollywood workers.

The vote on Assembly Bill 1138 was 73 in favor and one against, and comes a day after a similar bill, SB 630, passed 34-1 out of the state senate. The bills now head to the opposite houses as its co-authors say they are looking to expedite the committee vote process so that they can be passed by the legislature, signed by Gov. Gavin Newsom, and implemented by the California Film Commission all ideally before the legislative session ends for the year in September.

“We are in an emergency, given the unemployment levels and the loss of business in California due to the film industry, so we are working with the legislative leadership to find ways to have the bill go into effect this summer,” said Hollywood Asm. Rick Chavez Zbur, who is one of the co-authors on the bills.

The two bills had language removed that calls for the program’s cap to be increased from $330 million to $750 million, though that increase is still included in Gov. Gavin Newsom’s revised proposed budget for the coming fiscal year. Zbur says that there is high confidence among supporters of the program expansion that the cap raise will be approved in the final budget.

“The structural support that we are receiving from all of the entertainment unions, all of the studios, independent producers, the sound stage managers and owners is uniform, and I’ve never seen anything like it,” he said.

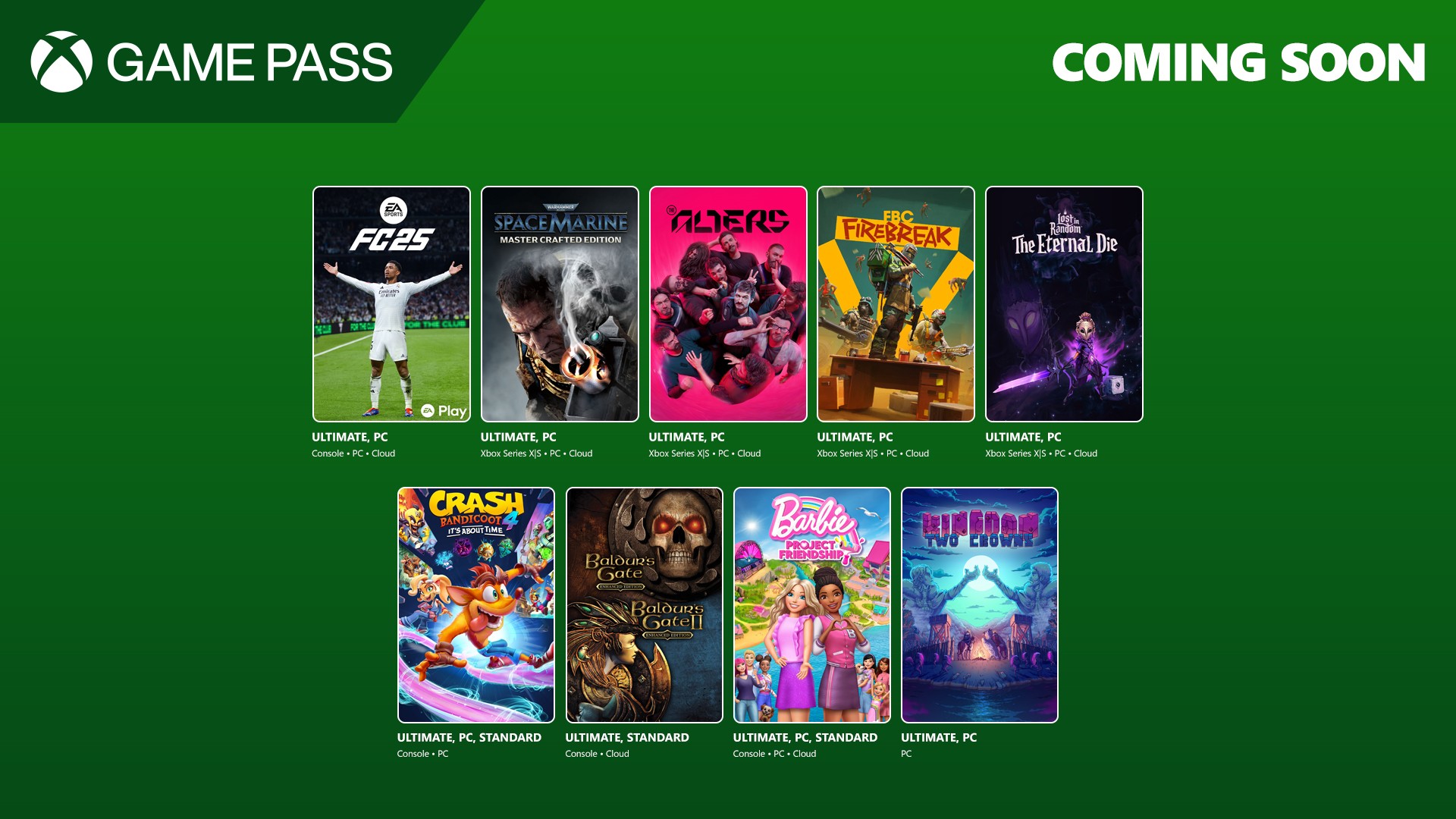

The two bills, known together as the California Film & TV Jobs Act, would expand the types of productions eligible for the tax credit, including animated productions and TV shows with a half-hour runtime.

The bill also allows productions that shoot in Los Angeles County and other select nearby shooting locations in Southern California to be eligible for an increased tax writeoff of 35% of all eligible spending.

According to the Bureau of Labor Statistics, the number of film and TV production jobs in California in 2024 fell by approximately 40,000 from the all-time high recorded in 2022, when ongoing demand for streaming shows and a need to catch up on projects delayed by the 2020 pandemic helped fuel a surge in productions.

But a variety of factors led to production jobs dropping not just in California but in other major American production hubs like Georgia and New York in 2024. Among them was an industry-wide cutback in production spending as media companies looked to make their streaming services profitable, as well as increased competition from other countries with their own production tax incentives.

The combination of that drop in jobs and the loss of work caused by the 2023 strikes that shut down productions for 191 days has led to thousands of entertainment workers in California facing serious financial struggle and has called the future of a cornerstone of the state’s economy into question.

The post California Assembly Passes Film Tax Bill to Expand Production Incentives appeared first on TheWrap.

![The Sweet Cheat [THE PAST REGAINED]](https://jonathanrosenbaum.net/wp-content/uploads/2011/05/timeregained-womanonstairs.png)

-0-8-screenshot.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)