Amex Centurion Card (Black Card) Revealed: Cost, Perks, And More

The American Express Centurion Card (often referred to simply as the ”Black Card”) is probably the most famous credit card in the world. Talk about a hyped card, as it’s exclusively available to those who are invited, and a countless number of rap songs reference it. While I’m a fan of rap, I generally don’t recommend making credit card decisions based on the lyrics of such music.

The American Express Centurion Card (often referred to simply as the “Black Card”) is probably the most famous credit card in the world. Talk about a hyped card, as it’s exclusively available to those who are invited, and a countless number of rap songs reference it. While I’m a fan of rap, I generally don’t recommend making credit card decisions based on the lyrics of such music.

Most of us won’t ever be invited to apply for the Black Card, but that doesn’t mean we can’t discuss it. What does it take to get an invitation, how much does it cost to hold onto, what are the benefits like, and is it worth it? Thanks to OMAAT reader Jason for sharing some of the latest updates to the card, which I’ve incorporated into this post.

The information and associated card details on this page for the Centurion Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

How to get an Amex Centurion Card invitation

As mentioned above, the Amex Centurion Card is invitation-only. The invitation requirements aren’t published, but it’s believed that an invitation is based both on your Amex card spending and your income.

Amex is tight-lipped about the requirements to get a Black Card, though I’ve heard the following thrown around as key minimum thresholds:

- You need to spend at least $250K per year on Amex cards

- You need to have an income of at least one million dollars per year

That’s not to say that either of those thresholds will get you an invitation, but I generally wouldn’t expect to get an invitation without meeting those requirements. For that matter, I wouldn’t be surprised if the requirements are even higher nowadays, given the inflation that we’ve seen.

While it’s possible to request to be considered for the Amex Centurion Card, don’t expect that you’ll be invited unless you can show a significant amount of spending and income.

There’s no publicly available information regarding how many people have the Amex Centurion Card. I’ve seen estimates suggesting that there are around 100,000 card members globally, with around 20% of those being in the United States. However, that could be totally off.

The information and associated card details on this page for the Centurion Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Amex Centurion Card initiation & annual fee

The Amex Centurion Card doesn’t just have an annual fee, but also has an initiation fee, as follows:

- There’s a $10,000 initiation fee

- There’s a $5,000 annual fee (that fee must be paid for each user, so you don’t get free authorized users on the card — on the plus side, they receive the full card perks)

So the first year, you can expect to pay $15,000 if you want the card, as you’ll be on the hook for the initiation fee and annual fee. That also assumes you don’t want to add any authorized users.

The information and associated card details on this page for the Centurion Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Amex Centurion Card perks & benefits

The Amex Centurion Card is built on the basics of The Platinum Card® from American Express (review), so it offers most of the perks you’ll find on that card, like Marriott Gold status, an annual CLEAR credit, an annual Uber benefit, access to lounges globally, etc.

But then there are all kinds of incremental perks as well, given the card’s $10,000 initiation fee and $5,000 annual fee. In addition to having a card that will no doubt turn heads, the Black Card offers the following perks:

- Delta SkyMiles Platinum Medallion status

- Hilton Diamond status

- IHG One Rewards Platinum status

- Hertz Platinum status

- Avis President’s Club status

- Up to $1,000 Saks credit per calendar year (in the form of a $250 credit per quarter)

- An Equinox Destination Access membership; this would ordinarily cost $300+ per month

- Expanded access to Centurion Lounges (fewer restrictions, reserved seating, champagne, more guesting privileges, etc.)

- Access to the Lufthansa First Lounges in Frankfurt (FRA) and Munich (MUC) when flying a Lufthansa Group airline the same day

- PS membership (with facilities at LAX and ATL), plus two complimentary visits per year to The Salon at PS, with each visit including a guest

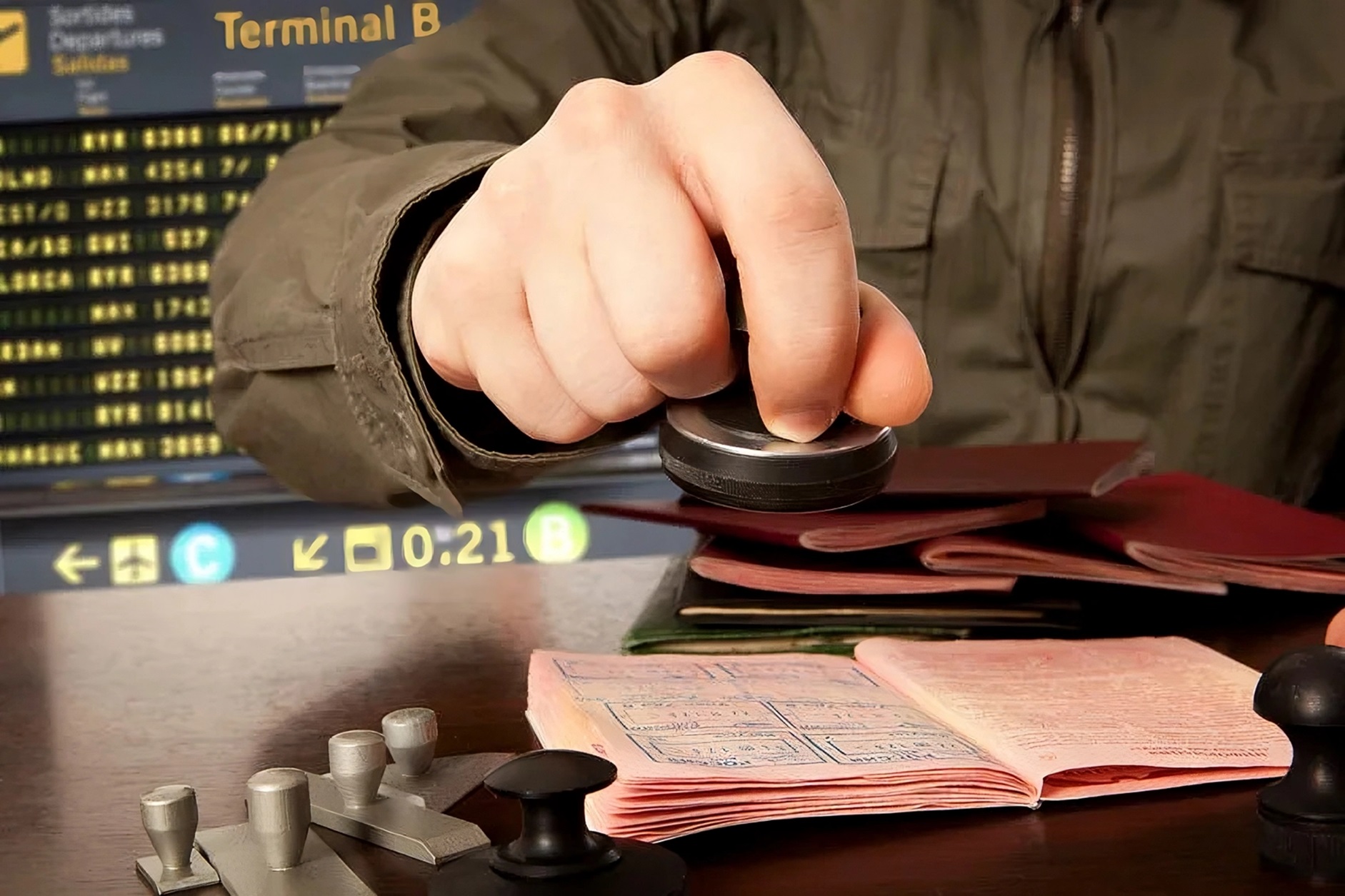

- Airport Butler service at select global airports, when bookings a first or business class ticket through Amex Travel, and in some cases it even includes an airport transfer

- 24/7 concierge service for hotels, restaurant reservations, etc.

- A rebate on “Pay With Points” bookings, which is potentially a way to redeem Amex points for more value — the personal version offers a 20% bonus, while the business version offers a 50% bonus

- Added benefits with Amex Fine Hotels + Resorts®, including increased credits, upgrades confirmed at booking at select properties, and more

The information and associated card details on this page for the Centurion Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Is the Amex Centurion Card worth it?

Purely in terms of benefits, I think the Amex Centurion Card could be worth it, as the benefits really add up. Admittedly that doesn’t account for the initiation fee, which changes the economics the first year, and I imagine people will amortize that differently.

On an ongoing basis you’re paying $5,000 per year, and here’s how I generally view the value of these benefits:

- If you’d otherwise pay for an Equinox membership, that recoups roughly two-thirds of the annual fee right there

- The $1,000 Saks credit can potentially be worth close to face value

- The hotel status is useful, but you can get that with other cards too — the Hilton Honors Aspire Card from American Express (review) also offers Hilton Diamond status, and the IHG One Rewards Premier Credit Card (review) also offers IHG Platinum status

- The Delta SkyMiles Platinum status is also useful if you fly Delta with any frequency, but personally I wouldn’t value that at more than $1,500 or so

- Then there are the standard lounge access perks, CLEAR credit, etc., which can add up as well

- The two PS visits per year are a treat, and if you’d otherwise pay for those visits, that’s potentially worth a significant amount

- If you fly Lufthansa Group carriers with any frequency, getting access to Lufthansa First Lounges in Frankfurt and Munich is a really useful perk

- Most of the other perks involve improved “soft” treatment, and everyone will value that differently; it’s hard to put a value to the concierge service, reserved seating in Centurion Lounges, etc.

For the right type of consumer, I do think the ongoing $5,000 annual fee can be justified based on the perks.

The information and associated card details on this page for the Hilton Honors American Express Aspire Card and Centurion Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

The problem with the Amex Centurion Card

Let’s be honest, most people who want the Amex Centurion Card don’t get it because they want an Equinox membership and most of the other perks. They get it because of the “cool” factor, and because they want to use it for in-person transactions.

And that’s where this card is so brilliant from Amex’s perspective, as it has a pretty uncompetitive rewards structure. The Amex Centurion Card offers a flat 1x points on all purchases, except purchases over $5,000 earn 1.5x points, with some caps.

The opportunity cost of spending money on this card is massive. Based on my valuation of points:

- There’s up to a 1.7% opportunity cost to putting everyday spending on this card

- There’s up to a 6.8% opportunity cost to putting dining spending on this card

You’re truly giving up value with every dollar you spend on the card, and that’s something I can’t wrap my head around. I know some people will say “well people who have the kind of money required to get this card don’t care about points.”

I don’t think that’s accurate. I think some people may value impressing others over getting the best return on their spending, but most people get rich by being smart with their money, and not flushing it down the drain. To me, sub-optimally using credit cards is like flushing money down the drain.

If you get the Amex Centurion Card and spend a lot of money on it, arguably the biggest “cost” of having the card would be the opportunity cost of your spending (which could be thousands of dollars in value), rather than the annual fee as such.

The information and associated card details on this page for the Centurion Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Bottom line

The Amex Centurion Card is the most famous credit card out there. Its invitation-only status plus high annual fee creates a lot of hype, and that’s understandable.

Forgetting the initiation fee, I do think the $5,000 annual fee can be justified pretty easily for the right type of consumer, especially if you’d otherwise pay for an Equinox membership. What I find much harder to justify is actually putting spending on the card.

Card rewards structures have improved so much over the years, but the Centurion Card is stuck in the past in that regard, offering 1x points on a vast majority of purchases, and up to 1.5x points on large purchases. There’s a huge opportunity cost to putting spending on the card.

Even so, people do spend a lot on the card, and I imagine it’s not because they’re looking to maximize their rewards. That’s probably the single factor that makes this card so lucrative for Amex — it’s not the fees people are paying, but rather, the spending they’re putting on the card.

What’s your take on the Amex Centurion Card? To OMAAT readers who have the card, what do you make of the value proposition? Do you use the card for spending, or just for the perks?

The information and associated card details on this page for the Centurion Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

![The Top 10 “Water Creature” Movies and Media (We Think) [Halloweenies Podcast]](https://bloody-disgusting.com/wp-content/uploads/2025/06/water-creatures-in-horror.jpeg)

![Where the Boys Are [BULL DURHAM]](https://jonathanrosenbaum.net/wp-content/uploads/2010/08/bull-durham.jpg)

![Communication Breakdown [SPANGLISH]](https://jonathanrosenbaum.net/wp-content/uploads/2011/05/spanglish.jpg)

![She Brought Crystal Stemware On A Budget Flight—And Created Her Own First Class [Roundup]](https://viewfromthewing.com/wp-content/uploads/2017/11/20170321_233854.jpg?#)

.jpg?#)