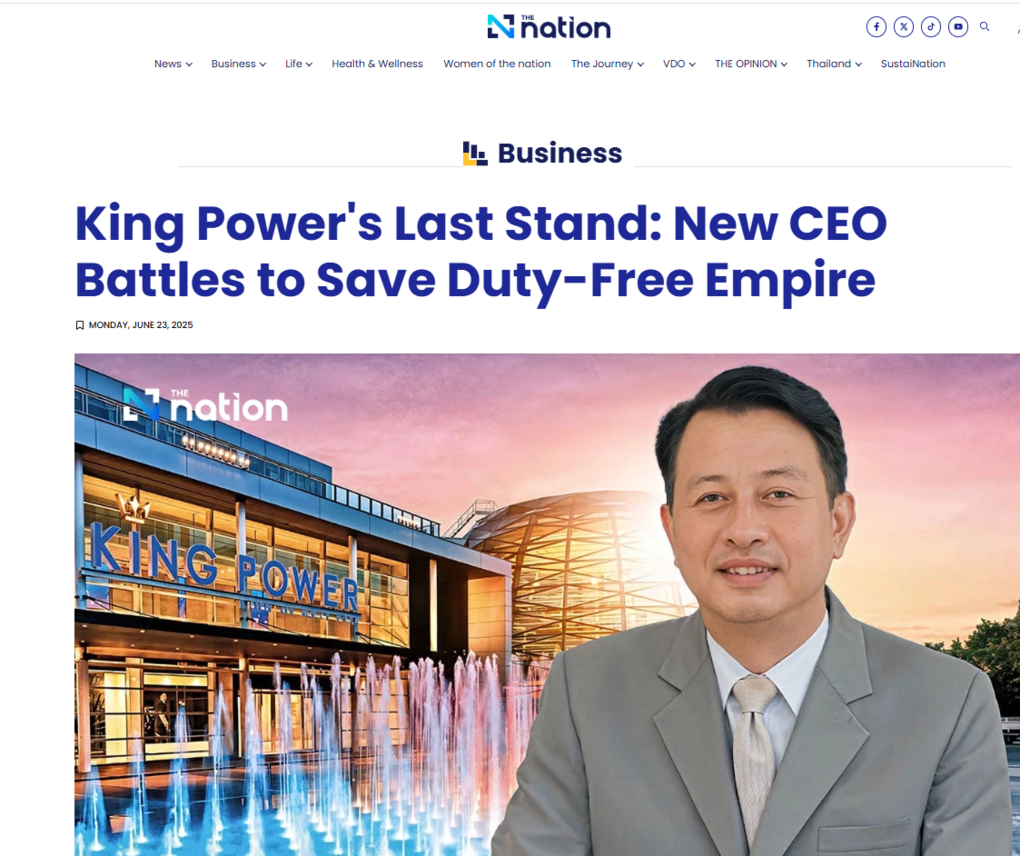

“It’s like a patient surviving on oxygen” – new King Power Duty Free CEO Nitinai Sirismatthakarn spells out retailer’s plight

“If it’s an upward cycle, we can inject resources to address shortages. But if it’s a downturn, it means removing ourselves from that industry entirely,” says new King Power Duty Free CEO (and former Airports of Thailand President) Nitinai Sirismatthakarn.

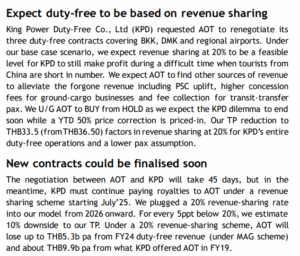

THAILAND. Newly appointed King Power Duty Free CEO Nitinai Sirismatthakarn has outlined the drastic problems facing the powerful Thai travel retailer, following the recent revelation that it will quit Airport of Thailand (AOT) airport contracts (1. Suvarnabhumi Airport; 2. Don Mueang Airport;

3. Three regional airports: Phuket, Chiang Mai and Hat Yai airports) if it does not gain substantial rent relief.

In an exclusive interview with influential Thai media title The Nation headed ‘King Power’s Last Stand: New CEO Battles to Save Duty-Free Empire’, Nitinai – who was AOT Managing Director from 2016 until 2024 – said, “It’s like a patient surviving on oxygen. The company’s intention was to ask AOT to remove the oxygen because we can’t cope anymore. This was the signal we sent.”

The report notes that unlike previous requests for rental relief (for example during the pandemic), King Power is now explicitly discussing contract termination – “a last resort that signals the depth of their financial distress”.

The Nation continues, “The root of King Power’s predicament lies in the minimum huarantee clauses of their concession agreements.

“These fixed annual payments to AOT were calculated using parameters and assumptions that the COVID-19 pandemic rendered obsolete.”

“The errors occurred due to miscalculations in the original assumptions, particularly regarding the COVID outbreak,” Nitinai told The Nation. “We need to examine which side made these errors by comparing minimum guarantee figures and ensure fairness under the changed circumstances.”

As reported, AOT is set to engage consultants for comprehensive, 60-day analysis of the contractual dilimma {story continues following the sidebar below}

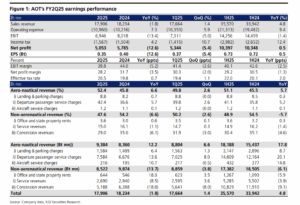

Moment of truth for Airports of ThailandDays earlier in another hard-hitting article headed ‘King Power: A Tale of Rise and Ruin’, The Nation wrote, “The numbers paint a stark picture of corporate distress. King Power’s current liabilities have surged dramatically, whilst its debt-to-equity ratio reached perilous levels in 2023.” The report noted the “profound” implications for AOT, which it said has grown dependent on King Power’s guaranteed payments. Commenting on former AOT President Nitinai Sirismatthakarn’s appointment as the travel retailer’s CEO and renowned sector knowledge and connections, one retail analyst told The Nation, “King Power over-leveraged itself with unsustainable minimum guarantee commitments. No amount of political nous can change the mathematics of tourism decline and excessive debt.” The report concluded: “For AOT, the dilemma is acute. The state enterprise must balance supporting its primary revenue source whilst avoiding accusations of continued favouritism. “If King Power’s minimum guarantee payments are reduced, AOT faces significant revenue shortfalls that will ultimately impact Thailand’s aviation infrastructure development. “Conversely, should negotiations fail and King Power terminate its contracts, AOT retains the right to call upon an 11 billion baht bank guarantee.” |

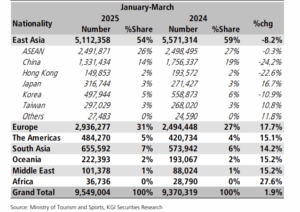

In a key part of the latest interview which will register right across the travel retail sector worldwide, Nitinai distinguishes between cyclical downturns – temporary setbacks in otherwise viable industries – and genuine disruption that fundamentally alters market dynamics.

“Business operations differ significantly,” he explained. “If it’s an upward cycle, we can inject resources to address shortages. But if it’s a downturn, it means removing ourselves from that industry entirely.”

Powerful stuff, well articulated. As the article notes, the critical question for King Power (and AOT) is whether current conditions (including the slump in Chinese visitor numbers and spending) represent disruption or a cycle.

A brilliantly written report concludes, “The stakes couldn’t be higher. For King Power, AOT’s response will determine whether this represents a temporary setback or the end of an era in Thai duty-free retail.”

Click here to read the full article.

![Passenger’s ‘Seat Bag’ Completely Blocks Tray Table, Making It Impossible to Use—What Would You Do? [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/06/plastic-bag-on-seat.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)