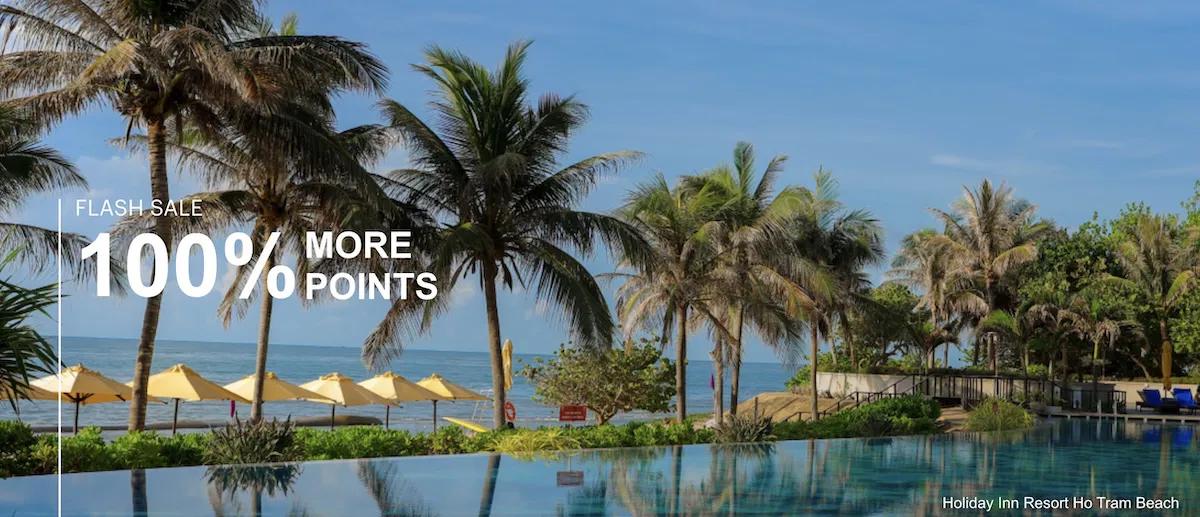

The trends to watch in Summer 2025: Travellers choosing culture over sun

Research across seven European cities shows increasing appetite for cultural attractions, outdoor pursuits, and authentic urban lodging - marking a shift in summer travel trends. The article The trends to watch in Summer 2025: Travellers choosing culture over sun first appeared in TravelDailyNews International.

FLORENCE – A new study by The Data Appeal Company, in collaboration with Mabrian – both part of Almawave Group, explores European Travel Trends for Summer 2025, highlighting the rising popularity of cultural city breaks across seven key European destinations: Barcelona, Berlin, Copenhagen, Helsinki, London, Paris, and Rome. While Mediterranean beach escapes remain a staple, more travellers are gravitating toward urban experiences rich in culture, creativity, and events – particularly during the shoulder months of June and September.

Drawing on insights from traveller sentiment, motivations, pricing fluctuations, and event performance, the report offers tourism professionals data-backed guidance to anticipate shifting demand, benchmark against 2024, and design more sustainable, balanced growth strategies for the high season ahead.

Cultural attractions drive satisfaction scores above 90 across Europe

A wide analysis of online reviews by The Data Appeal Company reveals traveller sentiment across Europe (April 2024–April 2025): data shows cultural attractions as the top driver of satisfaction, with consistent scores above 90/100 across all cities. Barcelona and Rome lead overall sentiment, fuelled by strong ratings in food, attractions, and short-term rentals. In contrast, hotel experiences lag – especially in Berlin and Copenhagen – suggesting growing price sensitivity and unmet expectations, particularly among domestic travellers.

Short-term rentals often outperform traditional hospitality in visitor perception, praised for good value, authenticity, and location convenience – especially for longer stays and group/family travel. While Paris still achieves an overall score of 87.0, low sentiment in short-term rentals and hospitality highlights mixed experiences.

Slight increase in U.S. travel intent to Paris, Rome and Barcelona

To better detect travel intent for the summer ahead, Mabrian* provided accurate insights about share of searches and air capacity.

Between April and September 2025, travel intent and air capacity data reveal American travellers’ interest in key European cultural cities like Paris, Rome, and Barcelona, with Share of Searches Index showing a slight rise by +0.04 percentage points along with a notable increase in U.S. seats availability—Barcelona (+14.4%), Rome (+4.3%), and Paris (+1.9%). While U.S. travellers’ Share of Searches Index (-0.12 pp) to London sees a moderate decrease, this city remains highly attractive for this market overall. This clearly shows that the recent tensions sparked by the Trump administration’s announcement of tariffs have not dampened Americans’ travel interest.

Other markets show varied trends: Paris gains seats availability from Germany and Greece, Rome does so from the UAE and Poland despite reducing availability in domestic flights, and Barcelona benefits from U.S. and Portuguese growth in air connectivity. Berlin faces slight declines due to low-cost carrier cuts, while Nordic countries continue to act as strategic hubs for long-haul travel, especially toward Asia. Overall, these shifts highlight evolving traveler preferences and airline confidence in cultural urban destinations across Europe even during summer months.

Culture still leads – but active and nature experiences gain up to +5.5pp

According to Mabrian’s drivers analysis, culture remains the primary motivation for city travel across Europe, growing since 2019, with Rome leading at 51% (+2.6 pp), followed by Berlin (48.2%, +2.9 pp) and Paris (49.5%, slight increase). While gastronomy is still the second most common reason to visit, its appeal is declining in most cities, especially London, which saw a 4 percentage point drop. In contrast, interest in active and outdoor experiences is rising sharply: London’s “Nature & Outdoors” motivation increased by +5.5 pp since 2019, becoming its third top driver, and “Active” experiences like cycling gained popularity in Paris (+4.5 pp), Rome, and Barcelona, reflecting a broader shift toward well-being, movement, and engaging, mood-enhancing travel experiences.

Rome and London rates rise over +10% – but August dips in demand

Online Travel Agencies’ rates and saturation analysed by Data Appeal show that from June to September 2025, London leads in hotel prices among major European cultural capitals, averaging the highest rates with a year-on-year increase of +10.6%, driven by constant demand and a busy events calendar. Rome shows the largest rate hike overall (+13.2%), with peak prices in June and September rather than mid-summer. In contrast, Berlin and Helsinki offer the most affordable stays, with Berlin’s prices lowest in August (€172) before rising for Oktoberfest, and Helsinki experiencing a significant price drop due to the absence of a major 2024 event.

A notable seasonal trend reveals that August, traditionally peak season in Europe, sees a dip in hotel demand and prices in most cities, as probably travelers favor coastal escapes and business travel slows. Instead, June and September have become the new high-demand months, especially in Paris and Barcelona, reflecting a shift toward early and late summer travel to avoid crowds, heat, and higher flight costs.

Flagship events redefine city tourism – London and Berlin lead with millions in impact

Events are key accelerators of travel demand, shaping both visitor flows and economic impact across major European cities. According to the Events module featured in D/AI Destinations, Data Appeal’s platform for DMOs, from June to September 2025, cities like London, Berlin, and Paris will see peaks in tourism driven by cultural programming – particularly in June and September, now the top-performing months for attendance and pricing. While concerts are the most frequent event type, festivals deliver greater returns by encouraging longer stays and higher spend.

Flagship events define each city’s seasonal rhythm and tourism economy. London’s Notting Hill Carnival leads with expected 2 million attendees and €205 million in revenue, followed by Berlin’s Carnival of Cultures with 1.1 million visitors. Paris and Rome capitalize on iconic cycling events like the Tour de France and Giro d’Italia, while Barcelona’s strategy prioritizes smaller, high-quality experiences like Sónar Festival, aligning cultural impact with urban sustainability.

“Tourism is evolving fast, and destinations that want to stay competitive must rely on real-time data and traveller insights to guide strategy,” says Mirko Lalli, CEO and founder of The Data Appeal Company. “This report offers a blueprint for balancing growth with livability – by investing in cultural attractions, improving hospitality experiences, and using sentiment as a dynamic KPI. According to the latest trends, cities should also embrace more outdoor and nature-based experiences, and distribute events more evenly across the summer to enhance visitor satisfaction and support sustainable, year-round tourism.”

*Mabrian’s assessment of the Share of Searches Index performance applies a three-point scale for increase or decrease (minor, moderate, significant), based on the magnitude of percentage point variations and their relative impact on the overall index value.

The article The trends to watch in Summer 2025: Travellers choosing culture over sun first appeared in TravelDailyNews International.

![‘Jurassic World Evolution 3’ Coming October 21 [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/06/evolution3.jpg)

![‘Dying Light: The Beast’ Arrives August 22 [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/06/thebeast.jpg)

![‘Deadpool VR’ Coming to Meta Quest 3 and 3s Later This Year [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/06/deadpoolvr.jpg)

![‘Resident Evil Requiem’ Coming February 27; Playable at Gamescom! [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/06/re9a.jpg)

![Metaphysical Pop [THE MUSIC OF CHANCE]](https://jonathanrosenbaum.net/wp-content/uploads/2011/05/the-music-of-chance-patinkin-kid-1.jpeg)

![‘I Don’t Understand You’ Directors Brian Crano & David Joseph Craig On Working With Nick Kroll, Andrew Rannells & Making A Vacation Horror Comedy [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/06/06125409/2.jpg)

![United Quietly Revives Solo Flyer Surcharge—Pay More If You Travel Alone [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/united-737-max-9.jpg?#)