Rémy Cointreau withdraws long-term guidance as full-year sales and profits fall sharply

Market volatility continues to weigh on performance, forcing Rémy Cointreau to withdraw 2029-30 projections in favour of modest mid-term growth targets for 2025-26.

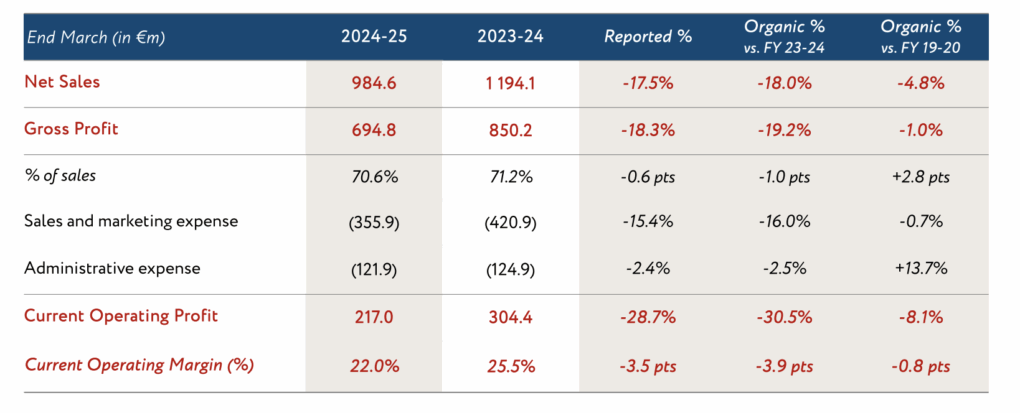

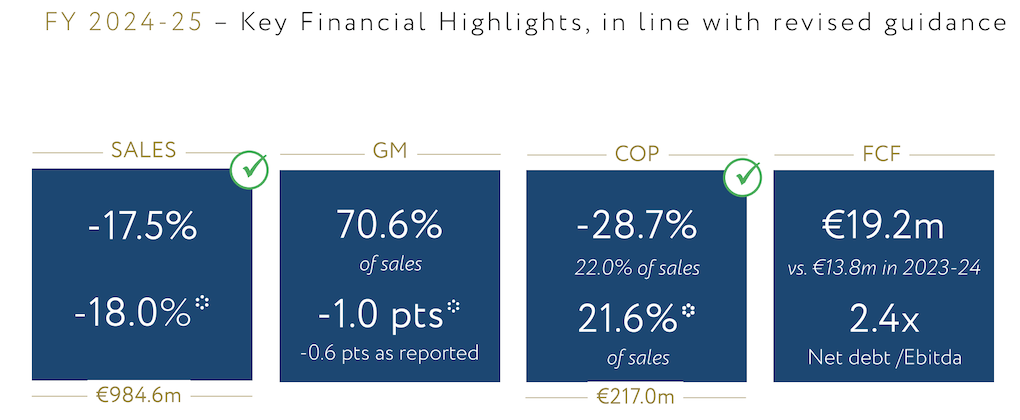

Leading drinks group Rémy Cointreau has reported full-year results for its 2024-25 financial year, with consolidated sales reaching €984.6 million, down -17.5% on a reported basis and -18% in organic terms.

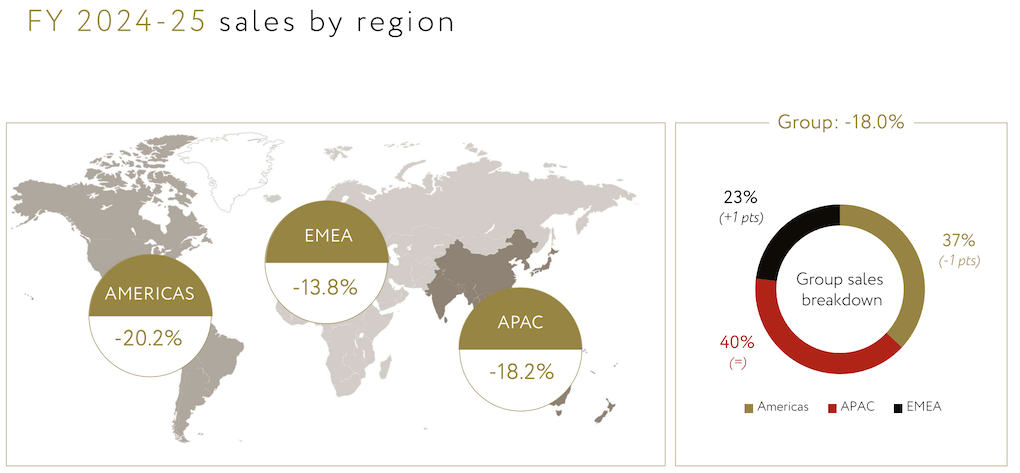

The company cited continued uncertainties in the Americas affecting its Cognac business and challenging market conditions in China and parts of EMEA as the primary reasons behind the contraction.

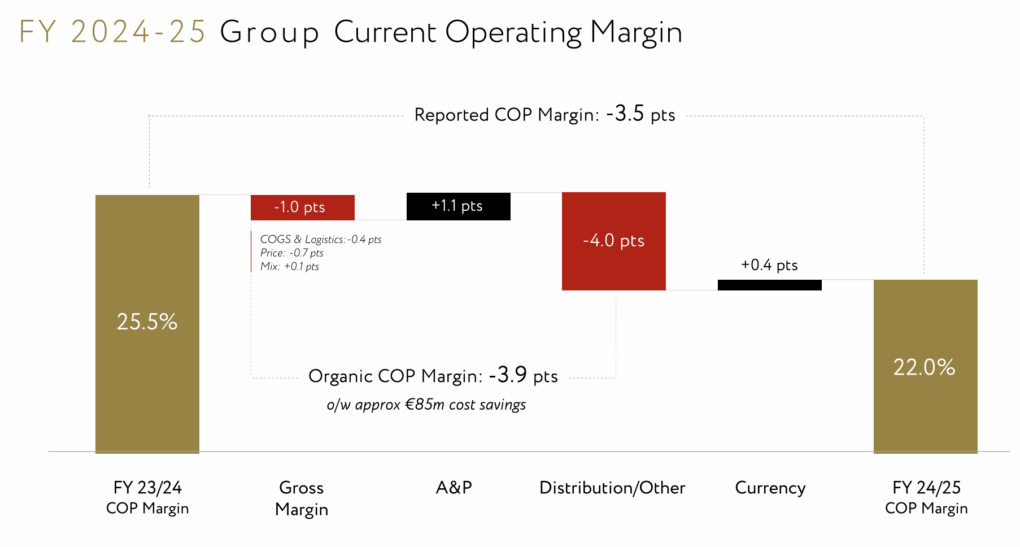

Rémy Cointreau maintained a gross margin of 70.6% in FY2024-25, down just one percentage point organically and up +2.8 points versus pre-pandemic levels, despite lower volumes and adverse price/mix effects.

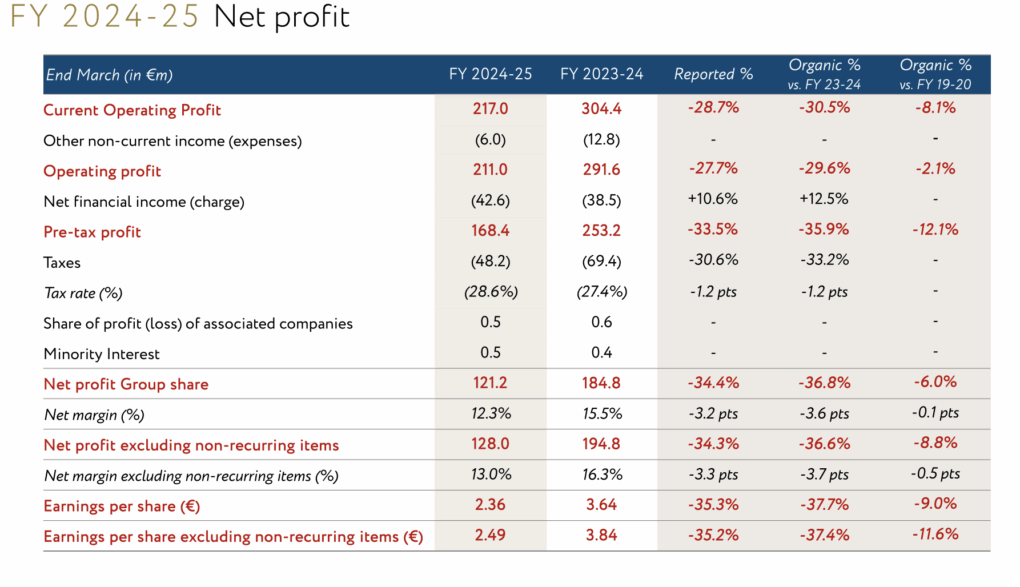

Operating profit fell -30.5% on an organic basis (-28.7% reported) to €217.0 million, representing a margin of 22%.

Despite this sharp drop, operating margin remained within the upper end of the group’s target range, aided by an aggressive cost-saving programme which delivered €85 million in efficiencies, exceeding the €50 million target. Net profit (group share) was €121.2 million, down -34.4%. Gross profit was €694.8 million (-19.2% decline).

Due to continued macroeconomic uncertainty and unresolved US-China trade tensions, the Group has withdrawn its 2029-30 targets. The decision coincides with the leadership transition later this month from Rémy Cointreau CEO Eric Vallat to Franck Marilly, who is expected to establish a revised strategic roadmap.

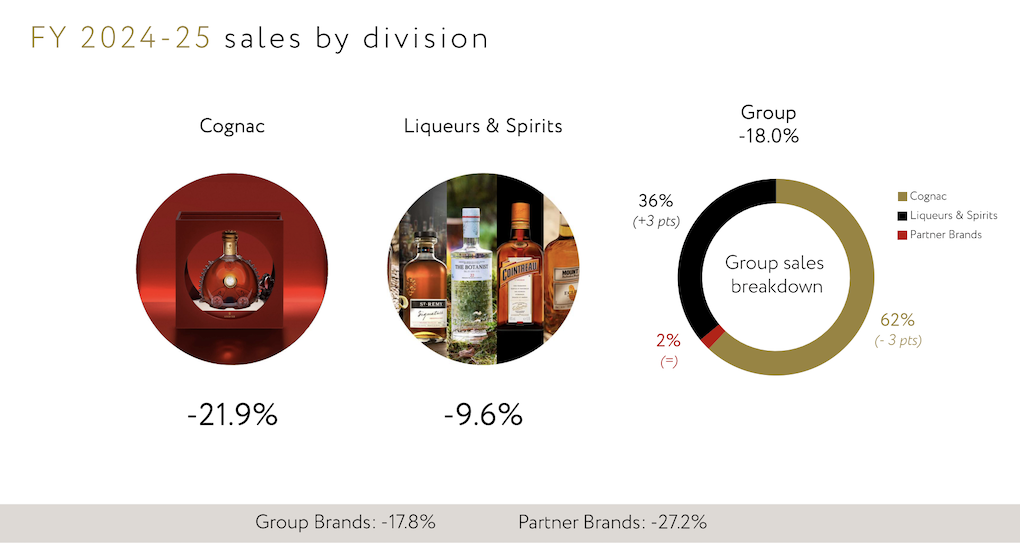

The Cognac division posted an organic sales decline of -21.9%, driven by a -15.6% drop in volumes and a -6.3% deterioration in price/mix. The decline was driven by inventory adjustments in the Americas, challenging market conditions in APAC — especially China — and mixed consumer trends in EMEA.

The Liqueurs & Spirits division proved more resilient, with sales down -9.6%. The division faced headwinds from tough conditions in the Americas, weaker EMEA consumption in H1, and a slowdown in whisky sales in China—but saw a strong sales rebound in the fourth quarter. Sales of Partner Brands were down by -27.2% on an organic basis.

2025-26 key objectives

Rémy Cointreau stated that the target to return to mid-single-digit organic sales growth in FY2025/26, led by a strong rebound in the US from the first quarter. Growth in the second half will be supported by improved phasing in China and the US.

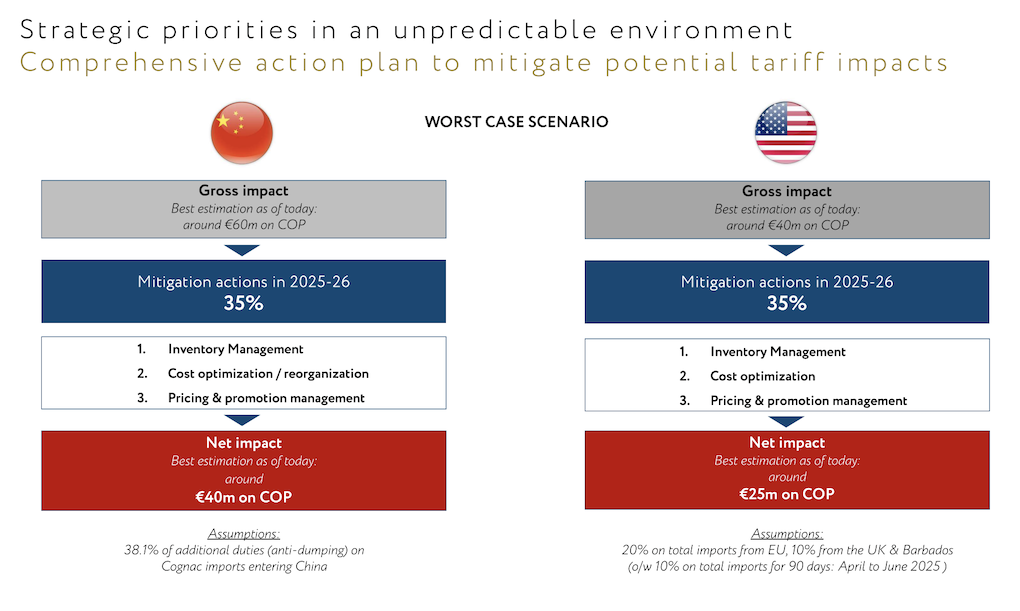

Excluding potential tariff increases, the group anticipated organic growth in operating margin in the high single-digit to low double-digit range. However, if tariffs materialise — 38.1% on Cognac into China and up to 20% on imports into the US — this could be negatively impacted by up to €100 million gross in the worst case scenario (€60 million in China and €40 million in the US).

Action plans are expected to offset the impact around 35%, capping the net impact at €65 million. In this scenario, COP would decline organically in the mid- to high-teen range. Rémy Cointreau expects adverse currency effects in FY2025/26 of €30–€35 million on sales and €10–€15 million on operating margin.

The Sustainable Exception

Remy Cointreau made substantial progress in implementing its transformation plan ‘The Sustainable Exception’, centred on three pillars: people, terroir and time.

In sustainability, Rémy Cointreau reduced its carbon footprint by -8% versus the prior year. It also cut water consumption by -38% from 2023-24 levels. These achievements contributed to improved CDP scores (A for Climate and B- for Water).

![‘Predator: Killer of Killers’ Directors on the Anthology Format and Historical Accuracy [Interview]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/06/Screenshot-2025-05-19-121021-1.jpg?fit=1694%2C802&ssl=1)

![Vampiro Returns — To Build a Cult on the Airwaves [Podcast]](https://bloody-disgusting.com/wp-content/uploads/2025/06/vAMPIRO-bANNER-TEMP-1024x576.png)

![Metaphysical Pop [THE MUSIC OF CHANCE]](https://jonathanrosenbaum.net/wp-content/uploads/2011/05/the-music-of-chance-patinkin-kid-1.jpeg)

![‘I Don’t Understand You’ Directors Brian Crano & David Joseph Craig On Working With Nick Kroll, Andrew Rannells & Making A Vacation Horror Comedy [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/06/06125409/2.jpg)

![United Quietly Revives Solo Flyer Surcharge—Pay More If You Travel Alone [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/united-737-max-9.jpg?#)