Chase is opening Sapphire Reserve cards for customers who don’t want them

When Chase revamped the Sapphire Reserve card and increased its welcome offer the other day, a lot of people decided to lob in an application. As part of the new application process, Chase now displays a popup if you’re not eligible for the welcome offer. You’re then given the choice as to whether to cancel […] The post Chase is opening Sapphire Reserve cards for customers who don’t want them appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

When Chase revamped the Sapphire Reserve card and increased its welcome offer the other day, a lot of people decided to lob in an application.

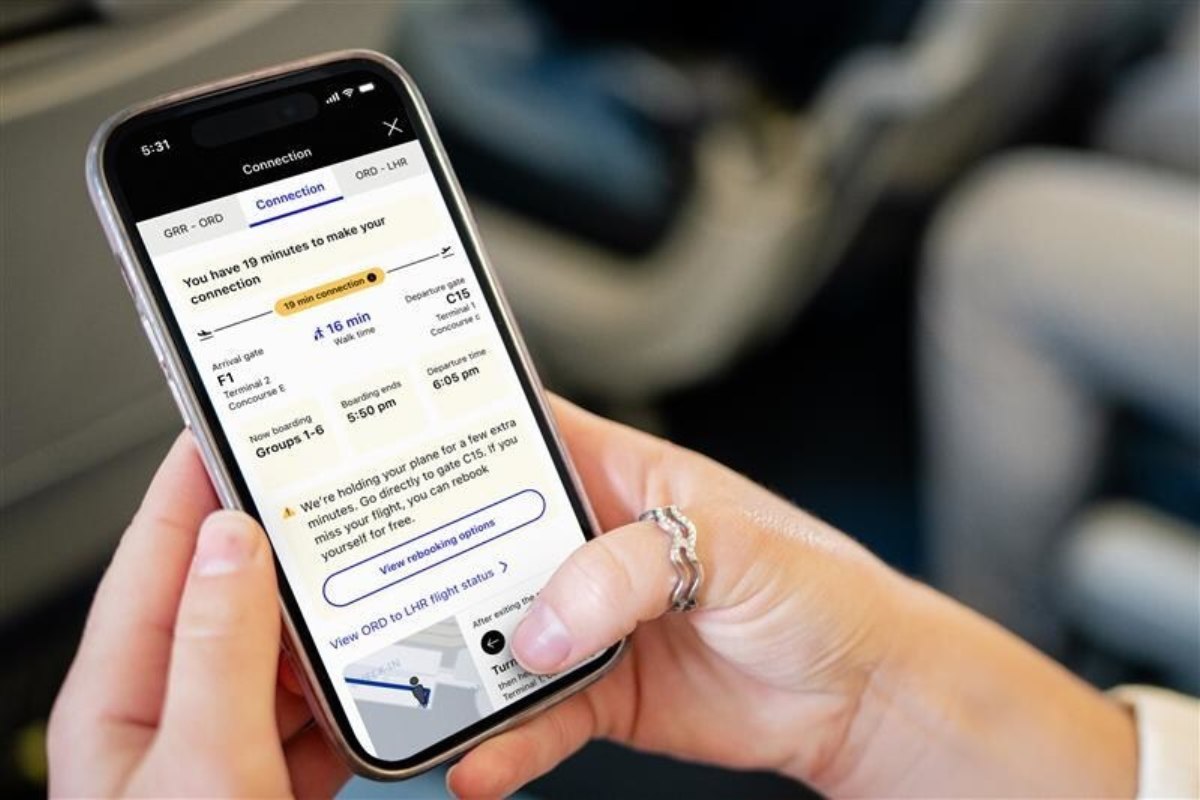

As part of the new application process, Chase now displays a popup if you’re not eligible for the welcome offer. You’re then given the choice as to whether to cancel your application, or proceed without a bonus being attached. That’s a better process than in the past as it means you can still get the card if you deem the benefits valuable enough even without earning a welcome offer.

It appears that this new process isn’t going entirely smoothly though. We’ve now heard from a few readers who decided not to proceed with their applications, but Chase opened new Sapphire Reserve cards for them anyway.

For example, we received the following email from a reader last night:

My son applied for the new personal Chase Reserve card. He got the pop up that he wasn’t eligible for the bonus. He declined the offer but unexpectedly the card landed in his account. I will be helping him discuss this with Chase, but I wanted to let people know it’s probably a good idea to take a screenshot if you get the pop up. We have applied plenty of times with Amex and gotten the pop up and declined with no problems. I did not think this would be a problem but now we did not screenshot it and might have to continue with this offer without the pop up in case Chase does not agree. I will keep you posted but I wanted other people to be aware in case they face this same issue.

Similarly, a different reader emailed us with the following account:

On June 23, I submitted an application for the Chase Sapphire Reserve. Just as you outlined, I was told I was ineligible for a welcome offer due to the number of cards recently opened. I was then given the choice to either proceed without the bonus or withdraw the application entirely. I chose to withdraw, and the Chase website confirmed that my application had been successfully withdrawn.

To my surprise, about ten minutes later I received an email saying I had been approved for the card, and the account immediately appeared in my Chase online portal.

I called Chase and spoke with a representative who acknowledged what happened and said the issue would be escalated. Since then, I’ve received conflicting information from different representatives. I’m currently dealing with the issue, but the resolution remains unclear.

I haven’t yet seen other reports of this specific glitch—being approved after withdrawing the application under the new policy—but I imagine others could run into the same problem now that this process has gone live.

I thought it was worth sharing as it raises important questions about the reliability of Chase’s new application process and what happens when it breaks down.

This issue appears to be the result of growing pains with Chase’s new popup procedure rather than being something more nefarious a la Wells Fargo.

If you find yourself in this frustrating position, you should reach out to Chase to report the problem. I fully expect them to make things right by closing the account and ensuring that the card either isn’t added to your credit report if it’s caught in time, or removed from your credit report if it’s not stopped in time.

In an ideal world, Chase would give an alternative option – you can keep the card open and they’ll attach the welcome offer to it as a gesture of good will. I’d be pleasantly surprised if that’s how they choose to proceed, but it’d be worth proactively suggesting that when speaking to Chase if that’s a resolution that would be agreeable for you.

The post Chase is opening Sapphire Reserve cards for customers who don’t want them appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![Watch: American Airlines Passengers Casually Walk Aisles During Taxi—Did Seatbelt Rules Just Disappear? [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/06/standing-in-aisle.jpg?#)

![This Switch 2 Accessory Is Making Fans Drop Their Consoles And The Manufacturer's Response Is Only Making Things Worse [Update: Everyone's Getting Free Upgraded Joy-Con Grips Following Death Threats]](https://i.kinja-img.com/image/upload/c_fill,h_675,pg_1,q_80,w_1200/d26954494c474d4929b602da22e51149.gif)

![[Podcast] Problem Framing: Rewire How You Think, Create, and Lead with Rory Sutherland](https://justcreative.com/wp-content/uploads/2025/06/rort-sutherland-35.png)